Travelers 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Commercial Insurance Resources, Inc.

On August 1, 2002, Commercial Insurance Resources, Inc. (CIRI), a subsidiary of the Company and the

holding company for the Gulf Insurance Group (Gulf), completed a transaction with a group of outside investors

and senior employees of Gulf. Capital investments made by the investors and employees included 9.7 million

shares of mandatorily convertible preferred stock for a purchase price of $8.83 per share, $50 million of

convertible notes and 0.4 million common shares for a purchase price of $8.83 per share, representing a 24%

ownership interest of CIRI, on a fully diluted basis. The dividend rate on the preferred stock was 6.0%. The

interest rate on the notes was 6.0% payable on an interest-only basis. The notes would have matured on

December 31, 2032. Trident II, L.P., Marsh & McLennan Capital Professionals Fund, L.P., Marsh & McLennan

Employees’ Securities Company, L.P. and Trident Gulf Holding, LLC (collectively Trident) invested $125

million, and a group of approximately 75 senior employees of Gulf invested $14 million. Fifty percent of the

Gulf senior employees’ investment was financed by CIRI. This financing was collateralized by the CIRI

securities purchased and was forgivable if Trident achieved certain investment returns. The applicable

agreements provided for registration rights and transfer rights and restrictions and other matters customarily

addressed in agreements with minority investors.

On May 28, 2004, The Travelers Indemnity Company (Indemnity), a subsidiary of the Company, completed

its purchase of all of the outstanding shares (8,970,000 shares) of the mandatorily convertible preferred stock

held by Trident at a purchase price of $8.83 per share and the convertible notes held by Trident for $46 million.

By June 30, 2004, Indemnity completed its purchase from employees of $7 million of the mandatorily

convertible preferred stock at a purchase price of $8.83 per share, convertible notes with an aggregate principal

amount of $4 million, and common equity of $3 million at a purchase price of $8.83 per share. The notes that

were previously issued to employees to finance 50% of their investment in CIRI were assumed by Indemnity as

part of the agreement to purchase the employees’ investments in CIRI. The excess of the cost to repurchase the

minority interest over the minority interest carrying value on the consolidated balance sheet was recorded as a

charge to additional paid-in capital during the second quarter.

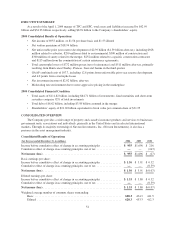

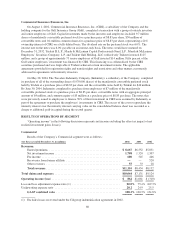

RESULTS OF OPERATIONS BY SEGMENT

“Operating income” in the following discussion represents net income excluding the after-tax impact of net

realized investment gains (losses).

Commercial

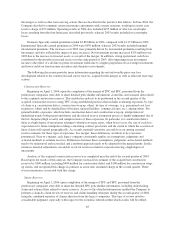

Results of the Company’s Commercial segment were as follows:

(for the year ended December 31, in millions) 2004 2003 2002

Revenues:

Earned premiums ................................................. $ 8,667 $6,552 $5,831

Net investment income ............................................. 1,708 1,324 1,307

Fee income ...................................................... 680 545 446

Recoveries from former affiliate ..................................... —— 520

Other revenues ................................................... 55 33 28

Total revenues ................................................... $11,110 $8,454 $8,132

Total claims and expenses ............................................. $10,064 $7,131 $9,124

Operating income (loss) ............................................... $ 862 $1,061 $ (310)

Loss and loss adjustment expense ratio (1) ................................. 80.0% 75.4% 109.3%

Underwriting expense ratio ............................................. 28.2 24.9 25.5

GAAP combined ratio ............................................ 108.2% 100.3% 134.8%

(1) Excludes losses recovered under the Citigroup indemnification agreement in 2002.

60