Travelers 2004 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

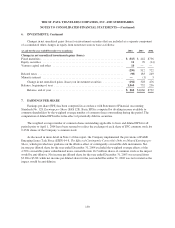

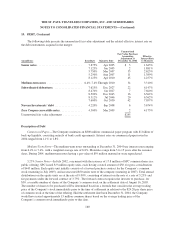

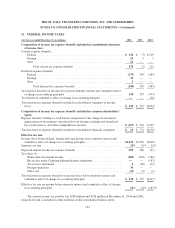

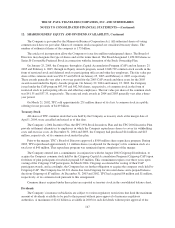

10. DEBT

Debt and convertible notes payable outstanding were as follows:

(at December 31, in millions) 2004 2003

Short-term:

Commercial paper* ................................................................ $ 499 $—

7.875% Senior notes due April 15, 2005* ............................................... 238 —

7.125% Senior notes due June 1, 2005* ................................................. 79 —

Medium-term notes maturing in 2005* ................................................. 99 —

Total short-term debt ........................................................... 915 —

Long-term:

Medium-term notes with various maturities from 2006 to 2010* ............................. 298 —

6.75% Senior notes due November 15, 2006 ............................................. 150 150

5.75% Senior notes due March 15, 2007* ............................................... 500 —

5.25% Senior notes due August 16, 2007* .............................................. 442 —

3.75% Senior notes due March 15, 2008 ................................................ 400 400

4.22% Nuveen Investments’ third-party debt due 2008* .................................... 305 —

4.50% Zero coupon convertible notes due 2009* ......................................... 117 —

8.125% Senior notes due April 15, 2010* ............................................... 250 —

7.81% Private placement notes due on various dates through 2011 ........................... 20 24

5.00% Senior notes due March 15, 2013 ................................................ 500 500

7.75% Senior notes due April 15, 2026 ................................................. 200 200

7.625% Subordinated debentures due December 15, 2027* ................................. 125 —

8.47% Subordinated debentures due January 10, 2027* .................................... 81 —

4.50% Convertible junior subordinated notes payable due April 15, 2032 ...................... 893 893

6.00% Convertible notes payable due December 31, 2032 .................................. —50

6.375% Senior notes due March 15, 2033 ............................................... 500 500

8.50% Subordinated debentures due December 15, 2045* .................................. 56 —

8.312% Subordinated debentures due July 1, 2046* ....................................... 73 —

7.60% Subordinated debentures due October 15, 2050* .................................... 593 —

Total long-term debt ............................................................ 5,503 2,717

Total debt principal ............................................................. 6,418 2,717

Unamortized fair value adjustment .................................................... 245 —

Unamortized debt issuance costs ...................................................... (39) (42)

Total debt .................................................................... $6,624 $2,675

* Debt instrument acquired in merger.

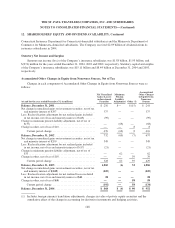

On April 1, 2004, The St. Paul Travelers Companies, Inc. fully and unconditionally guaranteed the payment

of all principal, premiums, if any, and interest on certain debt obligations of its subsidiaries TPC and TIGHI. The

guarantees pertain to the $150 million 6.75% Notes due 2006, the $400 million 3.75% Notes due 2008, the $500

million 5.00% Notes due 2013, the $200 million 7.75% Notes due 2026, the $893 million 4.5% Convertible

Notes due 2032 and the $500 million 6.375% Notes due 2033.

The Company’s consolidated balance sheet includes the debt instruments acquired in the merger, which

were recorded at fair value as of the acquisition date. The resulting fair value adjustment is being amortized over

the remaining life of the respective debt instruments using the effective-interest method. The amortization of the

fair value adjustment reduced interest expense by $56 million for the year ended December 31, 2004.

159