Travelers 2004 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

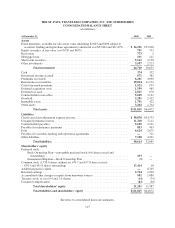

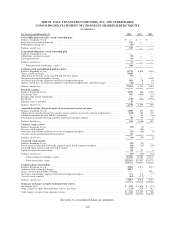

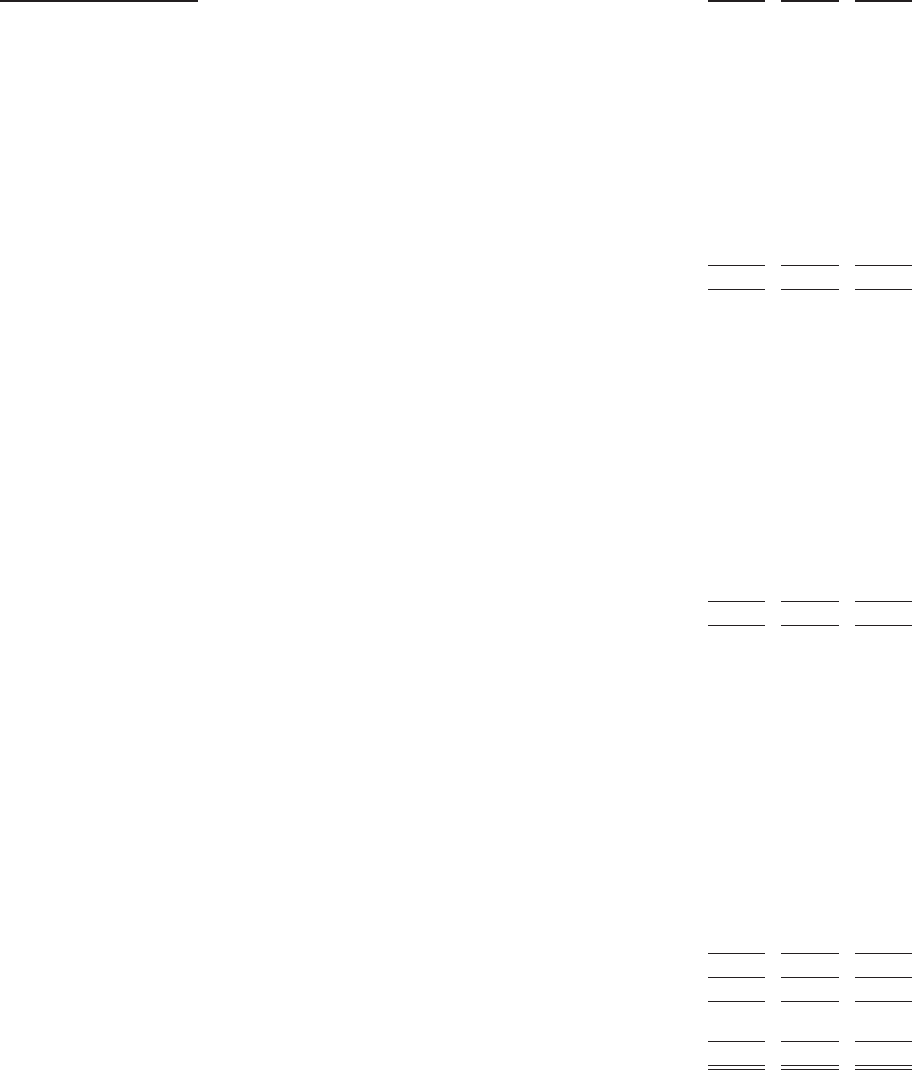

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

For the year ended December 31, 2004 2003 2002

Cash flows from operating activities

Net income (loss) ........................................................................ $ 955 $ 1,696 $ (27)

Adjustments to reconcile net income (loss) to net cash provided by operating activities

Net realized investment (gains) losses ................................................ 39 (38) (147)

Cumulative effect of changes in accounting principles, net of tax .......................... —— 243

Depreciation and amortization ...................................................... 541 85 42

Deferred federal income taxes (benefits) .............................................. (273) 539 (589)

Amortization of deferred policy acquisition costs ....................................... 2,979 1,984 1,810

Premiums receivable ............................................................. 320 (228) (204)

Reinsurance recoverables .......................................................... 584 (197) 70

Deferred acquisition costs ......................................................... (2,948) (2,076) (1,915)

Claims and claim adjustment expense reserves ......................................... 3,473 837 2,999

Unearned premium reserves ........................................................ (42) 651 793

Trading account activities ......................................................... 20 (16) 116

Recoveries from former affiliate .................................................... —361 159

Other ......................................................................... (407) 236 (424)

Net cash provided by operating activities ....................................... 5,241 3,834 2,926

Cash flows from investing activities

Proceeds from maturities of investments

Fixed maturities ..................................................................... 5,621 4,462 3,013

Mortgage loans ...................................................................... 76 59 22

Proceeds from sales of investments

Fixed maturities ..................................................................... 7,945 8,343 12,519

Equity securities ..................................................................... 265 254 127

Mortgage loans ...................................................................... 61 ——

Real estate ......................................................................... —11 23

Purchases of investments

Fixed maturities ..................................................................... (16,522) (15,555) (19,006)

Equity securities ..................................................................... (94) (61) (100)

Mortgage loans ...................................................................... (55) (12) (5)

Real estate ......................................................................... (22) — (1)

Short-term securities, (purchases) sales, net ................................................... (1,974) 2,910 (1,731)

Other investments, net .................................................................... 826 60 245

Securities transactions in course of settlement .................................................. (1,108) (2,946) 2,623

Net cash acquired in merger ................................................................ 166 ——

Other ................................................................................. 29 ——

Net cash used in investing activities ............................................ (4,786) (2,475) (2,271)

Cash flows from financing activities

Issuance of debt ......................................................................... 302 1,932 1,466

Payment of debt ......................................................................... (227) (1,103) (3)

Issuance of note payable to former affiliate .................................................... —— 250

Payment of note payable to former affiliate .................................................... —(700) (6,349)

Redemption of mandatorily redeemable securities of subsidiary trusts ............................... —(900) —

Treasury stock purchased .................................................................. —(40) —

Subsidiary’s treasury stock acquired ......................................................... (34) ——

Treasury stock acquired—net employee stock-based compensation ................................. (23) (18) (4)

Initial public offering ..................................................................... —— 4,090

Issuance of common stock-employee stock options ............................................. 129 40 10

Receipts from former affiliates ............................................................. —— 157

Dividends to shareholders ................................................................. (642) (282) —

Dividends to former affiliate ............................................................... —— (157)

Investment in (repurchase of) minority interest of subsidiary ...................................... (76) —90

Payment of dividend on subsidiary’s stock .................................................... (10) (5) (2)

Purchase of real estate from former affiliate ................................................... —— (68)

Transfer of employee benefit obligations to former affiliates ...................................... —(23) (172)

Transfer of lease obligations to former affiliate ................................................. —— (88)

Other ................................................................................. 41 — (20)

Net cash used in financing activities ............................................ (540) (1,099) (800)

Effect of exchange rate changes on cash ...................................................... 7——

Net increase (decrease) in cash ............................................................. (78) 260 (145)

Cash at beginning of period ................................................................ 352 92 237

Cash at end of period .................................................................... $ 274 $ 352 $ 92

Supplemental disclosure of cash flow information

Income taxes (refunded) paid ............................................................... $ 606 $ (64) $ 83

Interest paid ............................................................................ $ 286 $ 140 $ 141

See notes to consolidated financial statements.

117