Travelers 2004 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

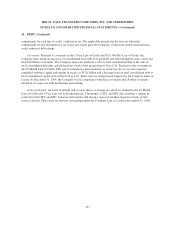

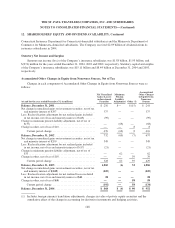

13. INCENTIVE PLANS, Continued

All original and reload stock options granted under the Company’s stock option programs had an exercise

price equal to the market value of the Company’s common stock on the date of grant. The stock option awards of

SPC assumed in the merger on April 1, 2004, the awards of CIRI converted on August 4, 2004, and the

replacement awards granted on August 20, 2002 retained the intrinsic value of the awards immediately prior to

being assumed, converted or replaced and therefore the exercise price either exceeded the market value or was

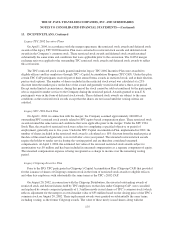

less than the market value on those respective dates. The following table presents the weighted average exercise

price and weighted average grant date fair value information with respect to these grants:

Options

Weighted

Average

Exercise

Price

Weighted

Average

Grant

Date Fair

Value

2004

Original awards

Exercise price equal to market at grant ............................ 1,881,158 $40.97 $ 9.27

Exercise price exceeds market at grant ............................ 350,188 $62.79 $ 6.42

Assumed awards

Exercise price exceeds market at grant ............................ 13,287,228 $45.13 $ 7.58

Exercise price less than market at grant ........................... 9,762,575 $31.88 $12.40

Total granted 2004 ....................................... 25,281,149 $39.95 $ 9.55

2003

Original awards

Exercise price equal to market at grant ............................ 675,390 $36.73 $ 2.86

2002

Original awards

Exercise price equal to market at grant ............................ 9,494,899 $41.90 $13.47

Replacement awards

Exercise price exceeds market at grant ............................ 12,006,955 $54.11 $ 7.25

Exercise price less than market at grant ........................... 12,650,955 $26.37 $16.80

Total granted 2002 ....................................... 34,152,809 $40.45 $12.51

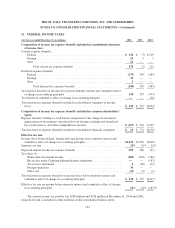

Stock Option Fair Value Information

The fair value effect of stock options is derived by application of a variation of the Black-Scholes option

pricing model.

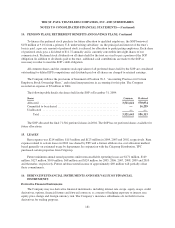

The significant assumptions used in estimating the fair value on the date of the grant for original options and

reload options granted in 2004, 2003 and 2002 and for the awards assumed on April 1, 2004 from SPC at the

merger and replacement awards issued August 20, 2002 to TPC employees who held Citigroup stock option

awards on that date were as follows:

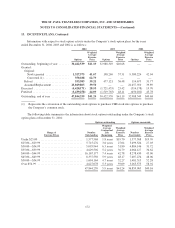

2004 2003 2002

Expected life of stock options ..................................... 3years 3 years 4 years

Expected volatility of the Company’s stock (1) ....................... 32.1% 29.4% 36.8%

Risk-free interest rate ........................................... 2.5% 2.04% 3.17%

Expected annual dividend per share ................................ $ 0.88 $ 0.60 $ 0.46

Expected annual forfeiture rate .................................... 5% 5% 5%

(1) The expected volatility is based on the average volatility of an industry peer group of entities because the

Company only became publicly traded in March 2002.

173