Travelers 2004 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

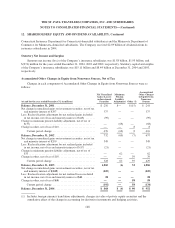

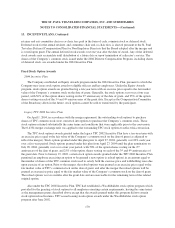

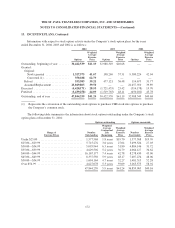

12. SHAREHOLDERS’ EQUITY AND DIVIDEND AVAILABILITY, Continued

The Company is governed by the Minnesota Business Corporation Act. All authorized shares of voting

common stock have no par value. Shares of common stock reacquired are considered treasury shares. The

number of authorized shares of the company is 1.75 billion.

The articles of incorporation allow the Company to issue five million undesignated shares. The Board of

Directors may designate the type of shares and set the terms thereof. The Board designated 1,450,000 shares as

Series B Convertible Preferred Stock in connection with the formation of the Stock Ownership Plan.

On January 25, 2005, the Company, through its Capital Accumulation Program (CAP) and on January 25,

2005 and February 4, 2005, through its Equity Awards program, issued 2,048,729 common stock awards in the

form of restricted stock and deferred stock to participating officers and other key employees. The fair value per

share of the common stock was $36.97 and $38.16 on January 25, 2005 and February 4, 2005, respectively.

These awards generally vest after a two-year period for the 2005 CAP awards and three years for the 2005

awards issued under the Equity Awards program. On January 22, 2004 and January 23, 2003, the Company

issued under the CAP program 847,593 and 842,368 shares, respectively, of common stock in the form of

restricted stock to participating officers and other key employees. The fair value per share of the common stock

was $41.35 and $37.33, respectively. The restricted stock awards in 2004 and 2003 generally vest after a three-

year period.

On March 21, 2002, TPC sold approximately 231 million shares of its class A common stock in a public

offering for net proceeds of $4.09 billion.

Treasury Stock

All shares of TPC common stock that were held by the Company as treasury stock at the merger date of

April 1, 2004, were cancelled and retired as of that date.

The Company’s 2004 Incentive Plan, the SPC 1994 Stock Incentives Plan and the TPC 2002 Incentive Plan

provide settlement alternatives to employees in which the Company repurchases shares to cover tax withholding

costs and exercise costs. At December 31, 2004 and 2003, the Company had purchased $14 million and $18

million, respectively, of its common stock under this plan.

Prior to the merger, TPC’s Board of Directors approved a $500 million share repurchase program. During

2003, TPC repurchased approximately 1.1 million shares (as adjusted for the merger) of its common stock at a

total cost of $40 million. That repurchase program was terminated upon completion of the merger.

The Company entered into a commitment, in conjunction with the August 2002 Citigroup Distribution, to

acquire the Company common stock held by the Citigroup Capital Accumulation Program (Citigroup CAP) upon

forfeiture of plan participants for which it prepaid $15 million. This commitment expires over three years upon

vesting of the Citigroup CAP participants. In March 2004, Citigroup accelerated the vesting of their CAP

participant awards, and accordingly, the Company has no further obligation to acquire the company stock held by

Citigroup CAP. The Company has 63,321 shares due from Citigroup for unvested shares and a prepaid balance

due from Citigroup of $7 million. At December 31, 2003 and 2002, TPC had acquired $4 million and $1 million,

respectively, of its common stock pursuant to this arrangement.

Common shares acquired under these plans are reported as treasury stock in the consolidated balance sheet.

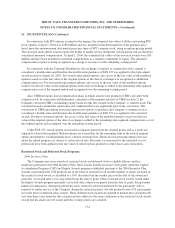

Dividends

The Company’s insurance subsidiaries are subject to various regulatory restrictions that limit the maximum

amount of dividends available to be paid to their parent without prior approval of insurance regulatory

authorities. A maximum of $2.61 billion is available in 2005 for such dividends without prior approval of the

167