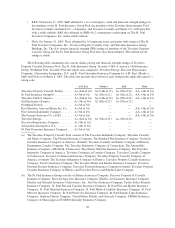

Travelers 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rate-making laws, which allow insurers to set certain premium rates for certain classes of insurance without

having to obtain the prior approval of the state insurance department. State insurance departments also conduct

periodic examinations of the affairs of insurance companies and require the filing of annual and other reports

relating to the financial condition of companies and other matters. At the present time, the Company’s insurance

subsidiaries are collectively licensed to transact insurance business in all states, the District of Columbia, Guam,

Puerto Rico, Bermuda, and the U.S. Virgin Islands, as well as Australia, Canada, New Zealand, the Philippines,

the United Kingdom, the Republic of Ireland, South Africa and Central and South America.

As part of ongoing, industry-wide investigations, the Company and its affiliates have received subpoenas

from several government agencies, including 14 states and the SEC. The areas of inquiry addressed to the

Company include its relationship with brokers and agents, the Company’s involvement with “non-traditional

insurance and reinsurance products,” lawyer liability insurance and branding requirements for salvage

automobiles. The Company is cooperating fully with these subpoenas and requests for information.

Insurance Holding Company Statutes

As a holding company, the Company is not regulated as an insurance company. However, as the Company

owns capital stock in insurance subsidiaries, it is subject to state insurance holding company statutes, as well as

certain other laws, of each of the states of domicile of the Company’s insurance subsidiaries. All holding

company statutes, as well as other laws, require disclosure and, in some instances, prior approval of material

transactions between an insurance company and an affiliate. The holding company statutes as well as other laws

also require, among other things, prior approval of an acquisition of control of a domestic insurer, some

transactions between affiliates and the payment of extraordinary dividends or distributions.

Insurance Regulation Concerning Dividends

The Company’s principal insurance subsidiaries are domiciled in the states of Connecticut and Minnesota.

The insurance holding company laws of both states applicable to the Company’s subsidiaries require notice to,

and approval by, the state insurance commissioner for the declaration or payment of any dividend, that together

with other distributions made within the preceding twelve months, exceeds the greater of 10% of the insurer’s

surplus as of the preceding December 31, or the insurer’s net income for the twelve-month period ending the

preceding December 31, in each case determined in accordance with statutory accounting practices. (In the case

of Minnesota, net income excludes realized investment gains for purposes of the calculation of the 10%

threshold.) This declaration or payment is further limited by adjusted unassigned surplus, as determined in

accordance with statutory accounting practices.

The insurance holding company laws of other states in which the Company’s insurance subsidiaries are

domiciled generally contain similar, although in some instances somewhat more restrictive, limitations on the

payment of dividends.

Assessments for Guaranty Funds and Second-Injury Funds and Other Mandatory Pooling Arrangements

Virtually all states require insurers licensed to do business in their state to bear a portion of the loss suffered

by some insureds as a result of the insolvency of other insurers. Depending upon state law, insurers can be

assessed an amount that is generally equal to between 1% and 2% of premiums written for the relevant lines of

insurance in that state each year to pay the claims of an insolvent insurer. Part of these payments is recoverable

through premium rates, premium tax credits or policy surcharges. Significant increases in assessments could limit

the ability of the Company’s insurance subsidiaries to recover such assessments through tax credits or other

means. In addition, there have been some legislative efforts to limit or repeal the tax offset provisions, which

efforts, to date, have been generally unsuccessful. These assessments are expected to increase in the future as a

result of recent insolvencies.

31