Travelers 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The declaration and payment of future dividends to holders of the Company’s common stock will be at the

discretion of the Company’s Board of Directors and will depend upon many factors, including the Company’s

financial condition, earnings, capital requirements of the Company’s operating subsidiaries, legal requirements,

regulatory constraints and other factors as the Board of Directors deems relevant. Dividends would be paid by the

Company only if declared by its Board of Directors out of funds legally available, subject to any other

restrictions that may be applicable to the Company.

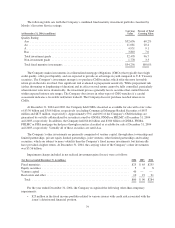

Upon completion of the merger on April 1, 2004, the Company acquired all obligations related to SPC’s

outstanding debt, which had a carrying value of $3.68 billion at the time of the merger. In accordance with

purchase accounting, the carrying value of the SPC debt acquired was adjusted to market value as of April 1,

2004 using the effective interest rate method, which resulted in a $301 million adjustment to increase the amount

of the Company’s consolidated debt outstanding. That fair value adjustment is being amortized over the

remaining life of the respective debt instruments acquired. That amortization, which totaled $56 million in 2004,

reduced reported interest expense.

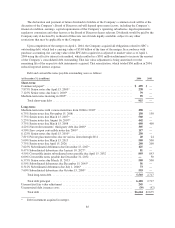

Debt and convertible notes payable outstanding were as follows:

(at December 31, in millions) 2004 2003

Short-term:

Commercial paper* ............................................................ $ 499 $—

7.875% Senior notes due April 15, 2005* .......................................... 238 —

7.125% Senior notes due June 1, 2005* ............................................ 79 —

Medium-term notes maturing in 2005* ............................................. 99 —

Total short-term debt ....................................................... 915 —

Long-term:

Medium-term notes with various maturities from 2006 to 2010* ........................ 298 —

6.75% Senior notes due November 15, 2006 ........................................ 150 150

5.75% Senior notes due March 15, 2007* .......................................... 500 —

5.25% Senior notes due August 16, 2007* .......................................... 442 —

3.75% Senior notes due March 15, 2008 ........................................... 400 400

4.22% Nuveen Investments’ third-party debt due 2008* ............................... 305 —

4.50% Zero coupon convertible notes due 2009* ..................................... 117 —

8.125% Senior notes due April 15, 2010* .......................................... 250 —

7.81% Private placement notes due on various dates through 2011 ....................... 20 24

5.00% Senior notes due March 15, 2013 ........................................... 500 500

7.75% Senior notes due April 15, 2026 ............................................ 200 200

7.625% Subordinated debentures due December 15, 2027* ............................. 125 —

8.47% Subordinated debentures due January 10, 2027* ................................ 81 —

4.50% Convertible junior subordinated notes payable due April 15, 2032 ................. 893 893

6.00% Convertible notes payable due December 31, 2032 ............................. —50

6.375% Senior notes due March 15, 2033 .......................................... 500 500

8.50% Subordinated debentures due December 15, 2045* .............................. 56 —

8.312% Subordinated debentures due July 1, 2046* .................................. 73 —

7.60% Subordinated debentures due October 15, 2050* ............................... 593 —

Total long-term debt ....................................................... 5,503 2,717

Total debt principal ........................................................ 6,418 2,717

Unamortized fair value adjustment ................................................ 245 —

Unamortized debt issuance costs ................................................. (39) (42)

Total debt ................................................................ $6,624 $2,675

* Debt instrument acquired in merger.

85