Travelers 2004 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

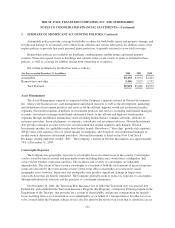

For stock-based employee awards granted, modified, or settled after December 31, 2002, the Company

applies the FAS 123 fair value method of accounting. Under this method, compensation cost is measured at the

grant date based on the fair value of the award and recognized ratably over the vesting period. For restricted

stock the fair value is measured at the market price of a share on the grant date while for stock options the fair

value is derived by the application of an option pricing model at date of grant.

For stock-based employee awards granted prior to January 1, 2003, the Company accounts for these awards

under the recognition and measurement principles of Accounting Principles Board Opinion No. 25 (APB 25),

“Accounting for Stock Issued to Employees”, and related interpretations. The Company continues to apply the

APB 25 accounting guidance for these awards as the Company elected to use the prospective recognition

transition alternative of FAS 148. Under this method, compensation cost is measured at grant date based upon the

market value of the underlying stock at the date of grant less any amount that the employee is required to pay and

recognized ratably over the vesting period. For employee restricted stock awards, the awards are granted at the

market value of the underlying stock on grant date and accordingly the market value of these awards is

recognized as compensation expense ratably over the vesting period. For employee stock option awards, the

awards are granted at an exercise price equal to the market value of the underlying common stock on the date of

the grant and accordingly there has been no employee compensation expense recognized in earnings for the stock

option awards granted prior to adoption of the FAS 123 fair value method of accounting on January 1, 2003.

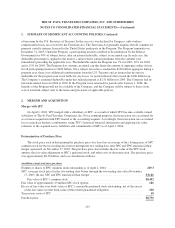

In connection with the merger in April 2004, the Company assumed 23 million outstanding SPC stock

options, of which 4 million remained unvested and assumed approximately 240,000 of outstanding SPC

restricted stock awards related to SPC equity-based compensation plans. These stock options and restricted stock

awards retained the same terms and conditions that were applicable prior to the merger. At April 1, 2004, the

estimated fair values of the unvested stock option awards and the restricted stock awards were $35 million and $9

million, respectively, and are included in unearned compensation as a separate component of equity. The

unearned compensation expense is being recognized as a charge to income over the remaining vesting period.

Additionally, in conjunction with the Citigroup Distribution in August 2002 (described in more detail in

note 3), the Company issued replacement awards for Citigroup awards. These replacement awards were issued at

the intrinsic value of each Citigroup option and the ratio of exercise price per share to the market value per share

was not reduced. Accordingly there was no compensation cost recognized in earnings for these replacement

awards.

128