Travelers 2004 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In most cases, multiple estimation methods will be valid for the particular facts and circumstances of the

claim liabilities being evaluated. This will result in a range of reasonable estimates for any particular claim

liability. The Company uses such range analyses to back test whether previously established estimates for

reserves at the reporting segments are reasonable, given subsequent information. Reported values found to be

closer to the endpoints of a range of reasonable estimates are subject to further detailed reviews. These reviews

may substantiate the validity of management’s recorded estimate or lead to a change in the reported estimate.

The exact boundary points of these ranges are more qualitative than quantitative in nature, as no clear line of

demarcation exists to determine when the set of underlying assumptions for an estimation method switches from

being reasonable to unreasonable. As a result, the Company does not believe that the endpoints of these ranges

are or would be comparable across companies. In addition, potential interactions among the different estimation

assumptions for different product lines make the aggregation of individual ranges a highly judgmental and

inexact process.

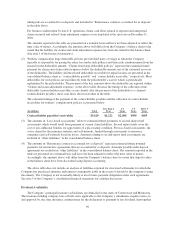

Property casualty insurance policies are either written on a claims made or on an occurrence basis. Policies

written on a claims made basis require that claims be reported during the policy period. Policies that are written

on an occurrence basis require that the insured demonstrate that a loss occurred in the policy period, even if the

insured reports the loss many years later.

Most general liability policies are written on an occurrence basis. These policies are subject to substantial

loss development over time as facts and circumstances change in the years following the policy issuance. The use

of the occurrence form accounts for much of the reserve development in asbestos and environmental exposures,

and it is also used to provide coverage for construction general liability, including construction defect.

Occurrence based forms of insurance for general liability exposures require substantial projection of various

trends, including future inflation and judicial interpretations and societal litigation dynamics, among others.

A key assumption in most actuarial analyses is that past patterns demonstrated in the data will repeat

themselves in the future, absent a material change in the associated risk factors discussed below. To the extent a

material change affecting the ultimate claim liability is known, such change is quantified to the extent possible

through an analysis of internal company and, if available and when appropriate, external data. Such a

measurement is specific to the facts and circumstances of the particular claim portfolio and the known change

being evaluated.

Informed management judgment is applied throughout the reserving process. This includes the application,

on a consistent basis over time, of various individual experiences and expertise to multiple sets of data and

analyses. In addition to actuaries, individuals involved with the reserving process also include underwriting and

claims personnel as well as other company management. Therefore, it is quite possible and, generally, likely that

management must consider varying individual viewpoints as part of its estimation of loss reserves. It is also

likely that during periods of significant change, such as a merger, consistent application of informed judgment

becomes even more complicated and difficult.

The variables discussed above in this general discussion have different impacts on reserve estimation

uncertainty for a given product line, depending on the length of the claim tail, the reporting lag, the impact of

individual claims and the complexity of the claim process for a given product line.

Product lines are generally classifiable as either long tail or short tail, based on the average length of time

between the event triggering claims under a policy and the final resolution of those claims. Short tail claims are

reported and settled quickly, resulting in less estimation variability. The longer the time before final claim

resolution, the greater the exposure to estimation risks and hence the greater the estimation uncertainty.

A major component of the claim tail is the reporting lag. The reporting lag, which is the time between the

event triggering a claim and the reporting of the claim to the insurer, makes estimating IBNR inherently more

94