Travelers 2004 Annual Report Download - page 77

Download and view the complete annual report

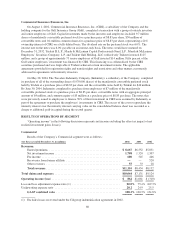

Please find page 77 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the merger as well as other net reserving actions that are described in the narrative that follows. In June 2004, the

Company decided to commute certain reinsurance agreements with a major reinsurer, resulting in a prior year

reserve charge of $75 million. Operating results in 2004 also included $155 million of after-tax catastrophe

losses resulting from the four hurricanes described previously, whereas 2003 results included no catastrophe

losses.

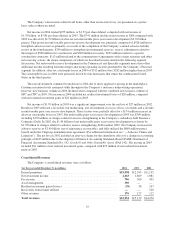

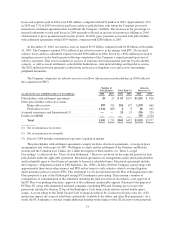

Domestic Specialty earned premiums totaled $3.86 billion in 2004, compared with $1.17 billion in 2003.

International Specialty earned premiums in 2004 were $930 million, whereas 2003 results included minimal

international premiums. The increases over 2003 were primarily driven by incremental premiums resulting from

the merger, and also reflected the impact of price increases. Net investment income increased $324 million over

2003 due to the increase in invested assets as a result of the merger. In addition, strong operational cash flows

contributed to the growth in invested assets over the same period of 2003. Also impacting in net investment

income is the effect of a decline in pretax investment yields due to a higher proportion of tax-exempt investments

and lower yields on fixed income securities and alternative investments.

The following discussion provides more information regarding the net unfavorable prior year loss

development related to the construction and surety reserves, acquired in the merger as well as other net reserving

actions.

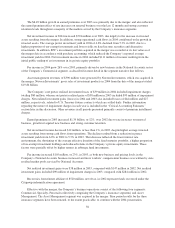

Construction Reserves

Beginning on April 1, 2004, upon the completion of the merger of TPC and SPC, personnel from the

predecessor companies were able to share detailed policyholder information, claim files and actuarial data related

to the acquired construction reserves. This enabled an analysis to be performed in the second quarter of the

acquired construction reserves using TPC’s long-established practices that includes evaluating exposures by type

of claim (e.g. construction defect, construction wrap up, other), by type of coverage, (e.g. guaranteed cost, loss

responsive, other) and by detailed line of business (general liability, commercial auto, etc.), among others. For

general liability exposures, which include construction defect and construction wrap-up, interpretation of

underlying trends (both present and future) and the related reserve estimation process is highly judgmental due to

the low frequency/high severity and complex nature of these exposures. In particular, for construction defect,

there is a high degree of uncertainty relating to whether coverage exists, when losses occur, the size of each loss,

expectations for future interpretive rulings concerning contract provisions and the extent to which the assertion of

these claims will expand geographically. As a result, material variations can and do occur among actuarial

reserve estimates for these types of exposures. In a merger, these differences are likely to be even more

pronounced. Prior to a merger, each legacy company consistently applies its assumptions, judgments and

actuarial methods to estimate reserves. Differences between these assumptions, judgments and actuarial methods

need to be understood and reconciled, and a uniform approach needs to be adopted for the merged entity. In this

situation, material adjustments can and do occur for reserves related to exposures having a high degree of

uncertainty.

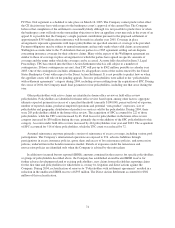

Analysis of the acquired construction reserves was completed near the end of the second quarter of 2004.

Based upon the results of this analysis, the Company increased its estimate of the acquired net construction

reserves by $500 million, including $400 million for construction defect and $100 million for construction wrap-

up claims, and recognized this change in estimate as an income statement charge in the second quarter. There

was no reinsurance associated with this charge.

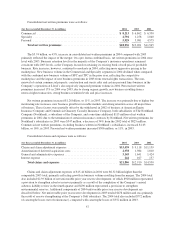

Surety Reserves

Beginning on April 1, 2004, upon completion of the merger of TPC and SPC, personnel from the

predecessor companies were able to share the detailed SPC policyholder information, including underwriting,

claim and actuarial files related to surety reserves. Access to this detailed information enabled the Company to

perform a claim-by-claim review of reserves and claims handling strategies during the second quarter of 2004

using the combined expertise of claims adjusters from the legacy companies. This type of review involves

considerable judgment, especially with respect to the economic outlook within which claims will be settled,

65