Travelers 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

end exchange-traded funds and $1.23 billion of mutual funds. Nuveen Investments’ positive net flows (equal to

the sum of sales, reinvestments and exchanges, less redemptions) totaled $11.23 billion during the nine months

ended December 31, 2004. Net flows were positive across all product lines in 2004. Assets under management

grew by $14.53 billion, or 14.4%, since the merger date, driven by the positive net flows and market appreciation

during that period. Assets under management at December 31, 2004 were comprised of $50.21 billion of

exchange-traded funds, $36.98 billion of retail managed accounts, $15.58 billion of institutional managed

accounts, and $12.68 billion of mutual funds. Investment advisory fees accounted for 93% of Nuveen

Investments revenues for the nine months ended December 31, 2004.

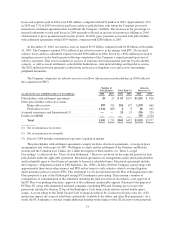

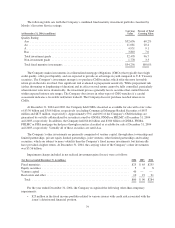

Interest Expense and Other

(for the year ended December 31, in millions) 2004 2003 2002

Revenues ............................................................... $14 $2$1

Net after-tax expense ...................................................... $(182) $(112) $(103)

Net after-tax expense for Interest Expense and Other for the year ended December 31, 2004 increased $70

million compared with 2003, primarily reflecting the impact of the merger. Included in the increase was $46

million of incremental interest expense on debt assumed in the merger. That amount was net of the favorable

impact of $36 million of the amortization of the fair value adjustment related to debt recorded at the acquisition

date. The 2004 total also included $9 million of charges related to the merger that were recorded in the second

quarter.

Interest Expense and Other in 2003 increased $9 million, after tax, primarily due to higher interest costs.

After-tax interest expense was $105 million in 2003 compared to $100 million in 2002. The increase in interest

expense in 2003 was primarily due to certain one time costs associated with the first and second quarter

refinancing activities that lowered average interest costs, but resulted in higher levels of temporary debt.

Temporary financing included $550 million first obtained in December 2002 in connection with the fourth

quarter 2002 asbestos reserve strengthening and $1.40 billion of senior notes issued on March 11, 2003. The

proceeds from the issuance of these senior notes were used to prepay and refinance a $500 million note to

Citigroup on March 11, 2003, and to redeem $900 million of trust preferred securities on April 9, 2003. For

additional information see “Liquidity and Capital Resources.”

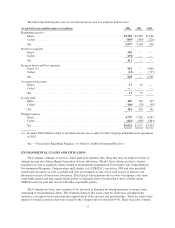

ASBESTOS CLAIMS AND LITIGATION

The Company believes that the property and casualty insurance industry has suffered from court decisions

and other trends that have attempted to expand insurance coverage for asbestos claims far beyond the intent of

insurers and policyholders. As a result, the Company continues to experience a significant number of asbestos

claims being tendered to the Company by the Company’s policyholders (which includes others seeking coverage

under a policy) including claims against the Company’s policyholders by individuals who do not appear to be

impaired by asbestos exposure. Factors underlying these increases include more intensive advertising by lawyers

seeking asbestos claimants, the increasing focus by plaintiffs on new and previously peripheral defendants and

entities seeking bankruptcy protection as a result of asbestos-related liabilities. In addition to contributing to the

increase in claims, bankruptcy proceedings may increase the volatility of asbestos-related losses by initially

delaying the reporting of claims and later by significantly accelerating and increasing loss payments by insurers,

including the Company. Bankruptcy proceedings are also causing increased settlement demands against those

policyholders who are not in bankruptcy but that remain in the tort system. Recently, in many jurisdictions, those

who allege very serious injury and who can present credible medical evidence of their injuries are receiving

priority trial settings in the courts, while those who have not shown any credible disease manifestation have their

hearing dates delayed or placed on an inactive docket. This trend, along with the focus on new and previously

peripheral defendants, contributes to the increase in loss and loss expense payments experienced by the

Company. In addition, the Company sees, as an emerging trend, an increase in the Company’s asbestos-related

71