Travelers 2004 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(3) Includes agreements with vendors to purchase system software administration and maintenance services.

(4) In connection with the sale of its insurance brokerage operations, the Company committed to acquire

brokerage services from the buyer through 2012. See note 17.

(5) Includes commitments to vendors entered into in the ordinary course of business for goods and services

including office supplies, archival services, etc.

(6) Represents estimated timing for fulfilling unfunded commitments for investments in real estate partnerships,

private equities and hedge funds.

The Company is not required to make any contributions to its qualified pension plan in 2005 and does not

have a best estimate of contributions expected to be paid to the qualified pension plan. Accordingly, any future

contributions are not included in the foregoing contractual obligation table.

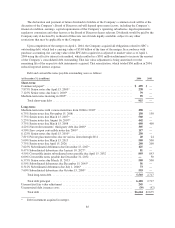

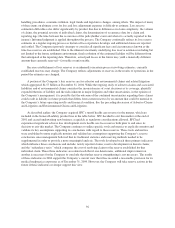

Estimated Claims and Claim Related Payments

The table below presents the amount and estimated future timing of claims and claim related payments. The

amounts do not represent the exact liability, but instead represent estimates, generally utilizing actuarial

projections techniques, at a given accounting date. These estimates include expectations of what the ultimate

settlement and administration of claims will cost based on the Company’s assessment of facts and circumstances

then known, review of historical settlement patterns, estimates of trends in claims severity, frequency, legal

theories of liability and other factors. Variables in the reserve estimation process can be affected by both internal

and external events, such as changes in claims handling procedures, economic inflation, legal trends and

legislative changes. Many of these items are not directly quantifiable, particularly on a prospective basis.

Additionally, there may be significant reporting lags between the occurrence of the policyholder event and the

time it is actually reported to the insurer. The future cash flows related to the items contained in the table below,

required estimation of both amount (including severity considerations) and timing. Amount and timing are

frequently estimated separately. An estimation of both amount and timing of future cash flows related to claims

and claim related payments is generally reliable only in the aggregate with some unavoidable estimation

uncertainty.

The following table includes estimated future claims and claims related payments, net of the estimated

reinsurance recoveries, where applicable, at December 31, 2004.

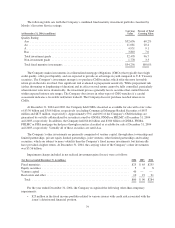

Estimated Payments by Period

(in millions) Total

Less

than 1

Year

1-3

Years

3-5

Years

After 5

Years

Estimated future payments resulting from:

(1) Claims and claim adjustment expenses ........... $42,283 $11,828 $13,331 $6,201 $10,923

(2) Claims from large deductible polices ............. — — — — —

(3) Loss-based assessments ....................... 195 10 46 24 115

(4) Reinsurance contracts accounted for as deposits .... 533 119 233 181 —

Total ..................................... $43,011 $11,957 $13,610 $6,406 $11,038

(1) The amounts in “Claims and claim adjustment expenses” in the table above represent the estimated timing

of future payments for both reported and unreported claims incurred and related claim adjustment expenses,

net of reinsurance recoverables. Therefore, estimated future payments include cash inflows related to

reinsurance arrangements that qualify for reinsurance accounting. A reinsurance agreement must indemnify

the insurer from insurance risk, i.e., the agreement must transfer amount and timing risk, in order to qualify

for reinsurance accounting. Timing risk is transferred if the agreement requires timely reimbursement from

the reinsurer to the insurer. Since the timing and amount of cash inflows from such reinsurance agreements

are highly correlated to the underlying payment of claims and claim adjustment expenses by the insurer, the

analysis above presents the estimated cash outlay for reported and unreported claims incurred and related

claim adjustment expense, net of reinsurance. Reinsurance agreements that do not transfer both amount and

89