Travelers 2004 Annual Report Download - page 137

Download and view the complete annual report

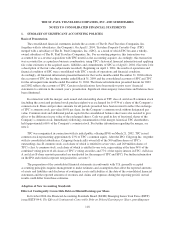

Please find page 137 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

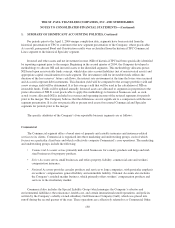

Included in the claims and claim adjustment expense reserves in the consolidated balance sheet are certain

reserves discounted to the present value of estimated future payments. The liabilities for losses for some long-

term disability payments under workers’ compensation insurance and workers’ compensation excess insurance,

which totaled $2.06 billion and $1.33 billion at December 31, 2004 and 2003, respectively, have been discounted

using rates of 3.5% to 5.0%. Reserves related to certain fixed and determinable asbestos-related settlements,

where all payment amounts and their timing are known, were discounted using a range of interest rates from

2.3% to 5.5% and totaled $48 million and $445 million at December 31, 2004 and 2003, respectively. Reserves

for certain assumed reinsurance coverage acquired in the merger, discounted using rates of 5.0% to 7.5%, were

$116 million at December 31, 2004.

In determining claims and claim adjustment expense reserves, the Company carries on a continuing review

of its overall position, its reserving techniques and its reinsurance. The reserves are also reviewed periodically by

a qualified actuary employed by the Company. These reserves represent the estimated ultimate cost of all

incurred claims and claim adjustment expenses. Since the reserves are based on estimates, the ultimate liability

may be more or less than such reserves. The effects of changes in such estimated reserves are included in the

results of operations in the period in which the estimates are changed. Such changes may be material to the

results of operations and financial condition and could occur in a future period.

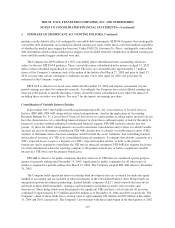

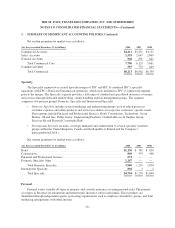

Securities Lending Payable and Dollar-Roll Repurchase Agreements

The Company engages in securities lending activities from which it generates net investment income from

the lending of certain of its investments to other institutions for short periods of time. Effective April 1, 2004, the

Company entered into a new securities lending agreement. Borrowers of these securities provide collateral equal

to at least 102% of the market value of the loaned securities plus accrued interest. This collateral is held by a

third party custodian, and the Company has the right to access the collateral only in the event that the institution

borrowing the Company’s securities is in default under the lending agreement. Therefore, the Company does not

recognize the receipt of the collateral held by the third party custodian or the obligation to return the collateral.

The loaned securities remain a recorded asset of the Company.

Prior to April 1, 2004, the Company engaged in securities lending activities where it received cash and

marketable securities as collateral. In those cases where cash collateral was received, the Company reinvested the

collateral in a short-term investment pool, the loaned securities remained a recorded asset of the Company and a

liability was recorded to recognize the Company’s obligation to return the collateral at the end of the loan. Where

marketable securities had been received as collateral, the collateral was held by a third party custodian, and the

Company had the right to access the collateral only in the event that the institution borrowing the Company’s

securities was in default under the lending agreement. In those cases where marketable securities were received

as collateral, the Company did not recognize the receipt of the collateral held by the third party custodian or the

obligation to return the collateral. The loaned securities remained a recorded asset of the Company.

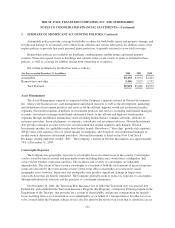

Other Liabilities

Included in other liabilities in the consolidated balance sheet is the Company’s estimate of its liability for

guaranty fund and other insurance-related assessments. The liability for expected state guaranty fund and other

premium-based assessments is recognized as the Company writes or becomes obligated to write or renew the

premiums on which the assessments are expected to be based. The liability for loss-based assessments is

recognized as the related losses are incurred. At December 31, 2004 and 2003, the Company had a liability of

$249 million and $180 million, respectively, for guaranty fund and other assessments and related recoveries of

125