Travelers 2004 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

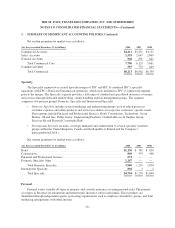

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

$31 million and $15 million, respectively. The liability for such assessments and their related recoveries are not

discounted for the time value of money. The assessments are expected to be paid over a period ranging from one

year to the life expectancy of certain workers’ compensation claimants and the recoveries are expected to occur

over the same period of time.

Also included in other liabilities is an accrual for policyholder dividends. Certain insurance contracts,

primarily workers’ compensation, are participating whereby dividends are paid to policyholders in accordance

with contract provisions. Net written premiums for participating dividend policies were approximately 1%, 1%

and 2% of total Company net written premiums for the years ended December 31, 2004, 2003 and 2002,

respectively. Policyholder dividends are accrued against earnings using best available estimates of amounts to be

paid. The liability accrued for policyholder dividends totaled $28 million and $12 million at December 31, 2004

and 2003, respectively.

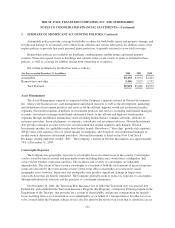

Statutory Accounting Practices

The Company’s insurance subsidiaries, domiciled principally in the states of Connecticut and Minnesota,

prepare statutory financial statements in accordance with the accounting practices prescribed or permitted by the

insurance departments of the states of domicile. Prescribed statutory accounting practices are those practices that

are incorporated directly or by reference in state laws, regulations, and general administrative rules applicable to

all insurance enterprises domiciled in a particular state. Permitted statutory accounting practices include practices

not prescribed by the domiciliary state, but allowed by the domiciliary state regulatory authority. The St. Paul

Fire and Marine Insurance Company (Fire and Marine) was granted a permitted practice in 2004 by the

Minnesota Department of Commerce regarding the valuation of certain investments in affiliated limited liability

companies, allowing it to value these investments based on their audited GAAP equity, which totaled $398

million as of December 31, 2004. It is not practicable to determine the impact on statutory surplus of this

permitted practice. The impact of any other permitted accounting practices on statutory surplus of the Company

is not material.

Premiums and Unearned Premium Reserves

Premiums are recognized as revenues pro rata over the policy period. Unearned premium reserves represent

the unexpired portion of policy premiums. Accrued retrospective premiums are included in premium balances

receivable. Premium balances receivable are reported net of an allowance for estimated uncollectible premium

amounts.

Ceded premiums are charged to income over the applicable term of the various reinsurance contracts with

third party reinsurers. Prepaid reinsurance premiums represent the unexpired portion of premiums ceded to

reinsurers and are reported as part of other assets.

Fee Income

Fee income includes servicing fees from carriers and revenues from large deductible policies and service

contracts and is recognized pro rata over the contract or policy periods.

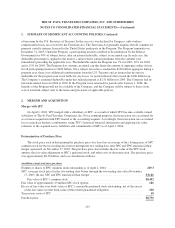

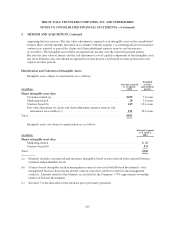

Asset Management

As a result of the merger, the Company held a 79% interest in Nuveen Investments, Inc. (“Nuveen

Investments,” formerly The John Nuveen Company), at December 31, 2004. The Company consolidates

126