Travelers 2004 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

6. INVESTMENTS, Continued

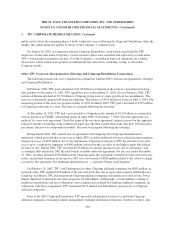

The Company makes investments in collateralized mortgage obligations (CMOs) that typically have high

credit quality, offer good liquidity and are expected to provide an advantage in yield compared to U.S. Treasury

securities. The Company’s investment strategy is to purchase CMO tranches which offer the most favorable

return given the risks involved. One significant risk evaluated is prepayment sensitivity. The Company does

invest in other types of CMO tranches if a careful assessment indicates a favorable risk/return tradeoff. The

Company does not purchase residual interests in CMOs.

At December 31, 2004 and 2003, the Company held CMOs classified as available for sale with a fair value

of $3.30 billion and $3.06 billion, respectively (excluding Commercial Mortgage-Backed Securities of $953

million and $875 million, respectively). Approximately 53% and 60% of the Company’s CMO holdings are

guaranteed by or fully collateralized by securities issued by GNMA, FNMA or FHLMC at December 31, 2004

and 2003, respectively. In addition, the Company held $4.66 billion and $3.80 billion of GNMA, FNMA,

FHLMC or FHA mortgage-backed pass-through securities classified as available for sale at December 31, 2004

and 2003, respectively. Virtually all of these securities are rated Aaa.

At December 31, 2004, the Company had $2.60 billion of securities on loan as part of a tri-party lending

agreement, and at December 31, 2003, the Company had $562 million of securities on loan for which cash

collateral was received. At December 31, 2004 and 2003, respectively, $32 million and $135 million of securities

were subject to dollar-roll repurchase agreements.

Proceeds from sales of fixed maturities classified as available for sale were $7.95 billion, $8.34 billion and

$12.52 billion in 2004, 2003 and 2002, respectively. Gross gains of $202 million, $282 million and $571 million

and gross losses of $126 million, $147 million and $148 million were realized on those sales in 2004, 2003 and

2002, respectively.

At December 31, 2004 and 2003, the Company’s insurance subsidiaries had $3.39 billion and $2.37 billion,

respectively, of securities on deposit at financial institutions in certain states pursuant to the respective states’

insurance regulatory authorities.

The Company’s subsidiaries, Unionamerica and St. Paul Re-U.K., and the Company’s operations at Lloyd’s

(all acquired in the merger) are required, as accredited U.S. reinsurers, to hold certain investments in trust in the

United States. These trust funds had a fair value of $359 million at December 31, 2004. Additionally,

Unionamerica, St. Paul Re-U.K. and Discover Re have funds deposited with third parties to be used as collateral

to secure various liabilities on behalf of insureds, cedants and other creditors. These funds had a fair value of $55

million at December 31, 2004. There is also $95 million of other investments being used as collateral to secure

our obligations under a series of insurance transactions.

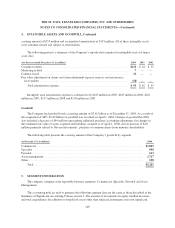

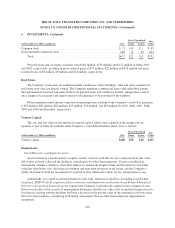

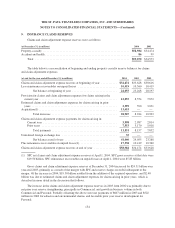

Equity Securities

The cost and fair value of investments in equity securities were as follows:

(at December 31, 2004, in millions) Cost

Gross Unrealized Fair

ValueGains Losses

Common stock ..................................................... $168 $31 $2 $197

Non-redeemable preferred stock ....................................... 552 45 3 594

Total ......................................................... $720 $76 $5 $791

145