Travelers 2004 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

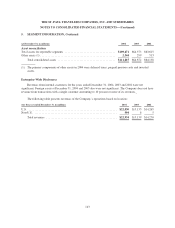

5. SEGMENT INFORMATION, Continued

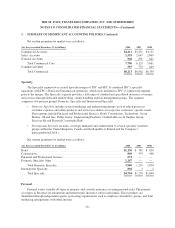

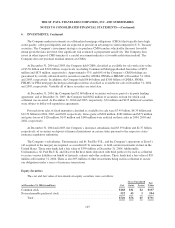

The following tables summarize the components of the Company’s revenues, operating income (loss) and

total assets by reportable business segments:

(at and for the year ended December 31, in millions) Commercial Specialty Personal

Asset

Management

Total

Reportable

Segments

2004 Revenues

Premiums ................................. $ 8,667 $ 4,791 $ 5,580 $ — $ 19,038

Net investment income ...................... 1,708 507 442 — 2,657

Fee income ............................... 680 26 — — 706

Asset management ......................... — — — 390 390

Other revenues ............................ 55 22 91 — 168

Total operating revenues (1) .................. $11,110 $ 5,346 $ 6,113 $ 390 $ 22,959

Amortization and depreciation ................ $ 1,244 $ 772 $ 952 $ 12 $ 2,980

Income tax expense (benefit) ................. 173 (447) 442 69 237

Operating income (loss) (1) .................. 862 (724) 939 88 1,165

Assets ................................... $67,454 $27,551 $11,813 $2,653 $109,471

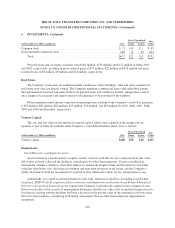

2003 Revenues

Premiums ................................. $ 6,552 $ 1,171 $ 4,822 $ — $ 12,545

Net investment income ...................... 1,324 183 361 — 1,868

Fee income ............................... 545 15 — — 560

Other revenues ............................ 33 8 85 — 126

Total operating revenues (1) .................. $ 8,454 $ 1,377 $ 5,268 $ — $ 15,099

Amortization and depreciation ................ $ 996 $ 245 $ 810 $ — $ 2,051

Income tax expense ......................... 268 95 221 — 584

Operating income (1) ....................... 1,061 234 492 — 1,787

Assets ................................... n/a(2) n/a(2) n/a(2) — $ 64,573

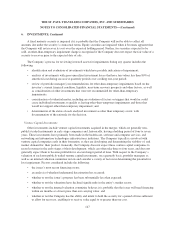

2002 Revenues

Premiums ................................. $ 5,831 $ 970 $ 4,354 $ — $ 11,155

Net investment income ...................... 1,307 188 385 — 1,880

Fee income ............................... 446 9 — — 455

Recoveries from former affiliate ............... 520 — — — 520

Other revenues ............................ 28 4 80 — 112

Total operating revenues (1) .................. $ 8,132 $ 1,171 $ 4,819 $ — $ 14,122

Amortization and depreciation ................ $ 898 $ 215 $ 739 $ — $ 1,852

Income tax expense (benefit) ................. (685) 76 143 — (466)

Operating income (loss) (1) .................. (310) 184 347 — 221

Assets ................................... n/a(2) n/a(2) n/a(2) — $ 63,625

(1) Operating revenues exclude net realized investment gains (losses). Operating income (loss) equals net

income (loss) excluding the after-tax impact of net realized investment gains (losses) and cumulative effect

of changes in accounting principles when applicable. For 2002, operating income also excludes non-

recurring restructuring charges related to periods prior to the spin-off from Citigroup.

(2) It is not practicable to restate assets by segment for prior periods.

141