Travelers 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.manage the mutual funds and exchange-traded funds of Nuveen Investments, and others provide investment

services for individual and institutional managed accounts. Additionally, Nuveen Investments, LLC, a registered

broker and dealer in securities under the Securities Exchange Act of 1934, as amended, provides investment

product distribution and related services for the Company’s managed funds, and, through March 2002, sponsored

and distributed the Company’s defined portfolios (unit investment trusts).

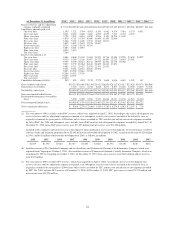

At December 31, 2004, Nuveen Investments’ assets under management totaled $115.45 billion, consisting

of $50.21 billion of exchange-traded funds, $36.98 billion of retail managed accounts, $15.58 billion of

institutional managed accounts and $12.68 billion of mutual funds.

On January 31, 2005, the Company announced its intention to explore alternatives for divestiture of

ownership of its 79% share of Nuveen Investments. The proposed divestiture reflects the Company’s strategic

decision to focus on its property-casualty business. The Company anticipates a sale within twelve months.

On March 3, 2005, Nuveen Investments filed a Registration Statement on Form S-3 in conjunction with the

Company’s intention to explore its strategic alternatives with respect to its equity interest in Nuveen Investments,

including a public offering or a sale to a third party.

CLAIMS MANAGEMENT

The Company’s claims management strategy and its execution are critical to operating results and business

retention. Claim payout and expense represent a substantial portion of every premium dollar the Company earns.

The Company’s claims management strategy is based on four core tenets:

• fair, efficient, fact-based claims management controls losses for the Company and its customers;

• use of advanced technology provides front-line claims professionals with necessary information and

facilitates prompt claim resolution;

• specialization of claims professionals and segmentation of claims by complexity, as indicated by

severity, coverage and causation, allow the Company to focus its resources effectively; and

• excellent customer service enhances customer retention.

Claim Services employs a diverse group of professionals, including claim adjusters, appraisers, attorneys,

investigators, system specialists and training, management and support personnel. Approved external service

providers, such as independent adjusters and appraisers, investigators and attorneys, are available for use as

appropriate.

Field claim management teams located in 72 offices in 45 states are organized to maintain focus on the

specific claim characteristics unique to the businesses within the Commercial, Personal and Specialty segments.

Claim teams with specialized skills, resources, and workflows are matched to the unique exposures of those

businesses with local claim management dedicated to achieving optimal results within each segment. The

Company’s home office operations provide additional support in the form of workflow design, quality

management, information technology, advanced management information and data analysis, training, financial

reporting and control, and human resources strategy. In addition to the field teams, claim staff is dedicated to

each of Personal’s single state companies in Florida, Massachusetts and New Jersey. This structure permits the

Company to maintain the economies of scale of a larger, established company while retaining the agility to

respond promptly to the needs of customers, brokers, agents and underwriters.

An integral part of the Company’s strategy to benefit customers and shareholders is its continuing

leadership in the fight against insurance fraud.

16