Travelers 2004 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

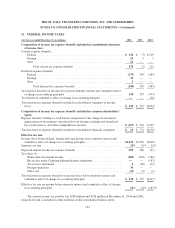

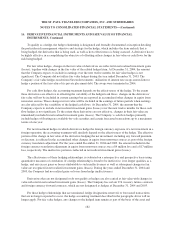

13. INCENTIVE PLANS, Continued

In connection with SPC options assumed in the merger, the estimated fair value of all the outstanding SPC

stock options at April 1, 2004 was $186 million and was included in the determination of the purchase price

based upon the announcement date market price per share of SPC common stock, using an option-pricing model.

The unvested stock option awards require the holder to render service during the vesting period and are therefore

considered unearned compensation. At April 1, 2004, the estimated fair values of the unvested awards were $35

million and have been included in unearned compensation as a separate component of equity. The unearned

compensation expense is being recognized as a charge to income over the remaining vesting period.

In connection with the Citigroup Distribution, the exchange of options in conjunction with a spinoff is

considered a modification and therefore the modification guidance of FAS 123 was applied to the replacement

awards issued on August 20, 2002. For vested replacement options, any excess of the fair value of the modified

options issued over the fair value of the original options at the date of exchange was recognized as additional

compensation cost. For nonvested replacement options, any excess of the fair value of the modified options

issued over the fair value of the original options at the date of exchange is added to the remaining unrecognized

compensation cost of the original option and recognized over the remaining vesting period.

Also, CIRI had equity-based compensation plans in which awards were granted in CIRI’s privately held

common stock. In connection with Indemnity’s purchase of the minority interest of CIRI (see note 2) the

Company converted CIRI’s outstanding equity based-awards into awards in the Company’s common stock. The

converted awards retained the same terms and conditions that were applicable prior to the conversion. The

conversion of CIRI outstanding nonvested options into options to purchase the Company’s common stock is

considered a modification and therefore the modification guidance of FAS 123 was applied to the converted

awards. For these converted options, the excess of the fair value of the modified options issued over the fair

value of the original options at the date of exchange is added to the remaining unrecognized compensation cost of

the original option and recognized over the remaining vesting period.

Under FAS 123, reload options are treated as separate grants from the original grants and as a result are

separately valued when granted. Reload options are exercisable for the remaining term of the related original

option and therefore would generally have a shorter estimated life. Shares received through option exercises

under the reload program are subject to restriction on sale. Discounts (as measured by the estimated cost of

protection) have been applied to the fair value of reload options granted to reflect these sales restrictions.

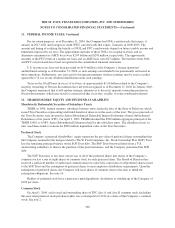

Restricted Stock and Deferred Stock Programs

2004 Incentive Plan

The Company may issue awards of restricted stock and deferred stock to eligible officers and key

employees pursuant to the 2004 Incentive Plan. Such awards include restricted stock grants under the Capital

Accumulation Program (CAP) and Equity Awards program established pursuant to the 2004 Incentive Plan.

Awards issued under the CAP program are in the form of restricted stock and the number of shares included in

the restricted stock award is calculated at a 10% discount from the market price on the date of the award and

generally vest in full after a two-year period from the date of grant. Other restricted stock awards issued under

the Equity Awards program generally vest in full after a three-year period from the date of grant. Except under

limited circumstances, during this period the stock cannot be sold or transferred by the participant, who is

required to render service to the Company during the restricted period. Awards granted to non-U.S. participants

are in the form of deferred stock awards. These deferred stock awards are granted at market price and generally

vest after three years from the date of grant and are subject to the same conditions as the restricted stock awards

except that the shares are not issued until the vesting criteria are satisfied.

174