Travelers 2004 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

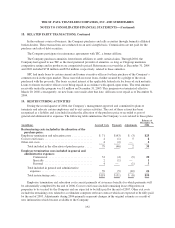

16. DERIVATIVE FINANCIAL INSTRUMENTS AND FAIR VALUE OF FINANCIAL

INSTRUMENTS, Continued

are ultimately reflected as an element of the yield. For cash flow hedges, any changes in fair value of the end-

user derivative remain in accumulated other changes in equity from nonowner sources, and are included in

earnings of future periods when earnings are also affected by the variability of the hedged cash flow. If the

hedged relationship was discontinued because a forecasted transaction will not occur when scheduled, any

changes in fair value of the end-user derivative are immediately reflected in net realized investment gains

(losses). During the years ended December 31, 2004 and 2003, the Company had no discontinued forecasted

transactions.

The Company also purchases investments that have embedded derivatives, primarily convertible debt

securities. These embedded derivatives are carried at fair value with changes in value reflected in net realized

investment gains (losses). The Company bifurcates an embedded derivative where a) the economic

characteristics and risks of the embedded instrument are not clearly and closely related to the economic

characteristics and risks of the host contract, b) the entire instrument would not otherwise be remeasured at fair

value, and c) a separate instrument with the same terms of the embedded instrument would meet the definition of

a derivative under FAS 133, Accounting for Derivative Instruments and Hedging Activities (FAS 133).

Derivatives embedded in convertible debt securities are reported on a combined basis with their host instrument

and are classified as fixed maturity securities.

The Company engaged in U.S. Treasury note futures transactions to modify the duration of the investment

portfolio. The Company enters into 90 day futures contracts on 2 year, 5 year, 10 year and 30 year U.S. Treasury

notes which require a daily mark to market settlement with the broker. The notional value of the open U.S.

Treasury futures contracts was $1.33 billion and $1.48 billion at December 31, 2004 and December 31, 2003,

respectively. These derivative instruments are not designated and do not qualify as hedges under FAS 133 and as

such the daily mark to market settlement is reflected in net realized investment gains (losses). Net realized

investment gains (losses) in 2004 and 2003 included losses of $44 million and $27 million, respectively, related

to U.S. Treasury futures contracts which are settled daily.

As a result of the merger, the Company acquired 6 million stock purchase warrants of Platinum

Underwriters, a publicly held company. These warrants are not designated and do not qualify as hedges under

FAS 133 and as such the mark to market is reflected in net realized gains (losses).

Nuveen Investments entered into swap agreements that have not been designated as hedging instruments.

The swap agreements are used to support new products offered by Nuveen Investments. The mark-to-market

valuations were not significant and are reflected in results of operations.

During the third quarter of 2004, the Company terminated its interest rate swap agreements which had been

acquired in the merger. The notional value of these swaps was $730 million at the time of the termination. These

interest rate swap agreements were used to manage exposure of certain of its fixed rate debt to changes in interest

rates. These derivative instruments did not qualify for continued hedge accounting following the merger and, as

such, the mark-to-market changes in fair value were reflected in net realized investment gains and losses prior to

the termination of these agreements.

Fair Value of Financial Instruments

The Company uses various financial instruments in the normal course of its business. Certain insurance

contracts are excluded by FAS 107, Disclosures about Fair Value of Financial Instruments, and, therefore, are

not included in the amounts discussed.

183