Travelers 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

homeowners insurance for dwellings, condominiums and rental property contents. The Company also writes

coverage for personal watercraft, personal articles such as jewelry, and umbrella liability protection.

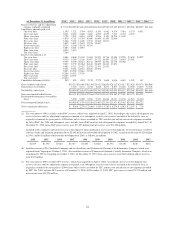

Geographic Distribution

The following table shows the distribution of Personal’s direct written premiums for the states that

accounted for the majority of premium volume for the year ended December 31, 2004:

State

%of

Total

New York ........................................................... 17.9%

Texas .............................................................. 8.9

Massachusetts ........................................................ 7.5

Pennsylvania ......................................................... 7.2

New Jersey .......................................................... 6.9

Florida ............................................................. 5.3

Virginia ............................................................. 4.7

Georgia ............................................................. 4.3

Connecticut .......................................................... 4.2

California ........................................................... 3.7

All Others (1) ........................................................ 29.4

Total ............................................................... 100.0%

(1) No other single state accounted for 3.0% or more of the total direct written premiums written in 2004 by the

Company.

ASSET MANAGEMENT

Nuveen Investments, Inc. is the Company’s asset management subsidiary. The Company held a 79% interest

in Nuveen Investments at December 31, 2004.

Nuveen Investments’ core businesses are asset management and related research, as well as the

development, marketing and distribution of investment products and services for the affluent, high-net-worth and

institutional market segments. Nuveen Investments distributes its investment products and services, including

individually managed accounts, closed-end exchange-traded funds and mutual funds, to the affluent and high-net-

worth market segments through unaffiliated intermediary firms including broker/dealers, commercial banks,

affiliates of insurance providers, financial planners, accountants, consultants and investment advisors. Nuveen

Investments also provides managed account services to several institutional market segments and channels.

Nuveen Investments markets its capabilities under four distinct brands: Rittenhouse (“blue-chip” growth-style

equities); NWQ (value-style equities); Nuveen (fixed-income investments); and Symphony (an institutional

manager of market-neutral alternative investment portfolios). Nuveen Investments is listed on the New York

Stock Exchange, trading under the symbol “JNC.”

Nuveen Investments’ primary business activities generate three principal sources of revenue: (1) advisory

fees earned on assets under management, including exchange-traded funds, separately managed accounts and

mutual funds; (2) underwriting and distribution revenues earned upon the sale of certain investment products;

and (3) performance fees earned on certain institutional accounts based on the performance of such accounts.

Advisory fees accounted for 93% of Nuveen Investments’ total revenues in 2004.

Operations of Nuveen Investments are organized around its principal advisory subsidiaries, which are

registered investment advisors under the Investment Advisers Act of 1940. Certain of these advisory subsidiaries

15