Travelers 2004 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

timing risk are accounted for as deposits and included in “Reinsurance contracts accounted for as deposits”

in the table above.

For business underwritten by non-U.S. operations, future cash flows related to reported and unreported

claims incurred and related claim adjustment expenses were translated at the spot rate on December 31,

2004.

The amounts reported in the table are presented on a nominal basis and have not been adjusted to reflect the

time value of money. Accordingly, the amounts above will differ from the Company’s balance sheet to the

extent that the liability for claims and claim adjustment expenses has been discounted in the balance sheet.

(See note 1 of the financial statements.)

(2) Workers compensation large deductible policies provide third party coverage in which the Company

typically is responsible for paying the entire loss under such policies and then seeks reimbursement from the

insured for the deductible amount. “Claims from large deductible policies” represent the estimated future

payment for claims and claim related expenses below the deductible amount, net of the estimated recovery

of the deductible. The liability and the related deductible receivable for unpaid claims are presented in the

consolidated balance sheet as “contractholder payable” and “contractholder receivable,” respectively. Most

deductibles for such policies are paid directly from the policyholder’s escrow which is periodically

replenished by the policyholder. The payment of the loss amounts above the deductible are reported within

“Claims and claim adjustment expenses” in the above table. Because the timing of the collection of the

deductible (contractholder receivable) occurs shortly after the payment of the deductible to a claimant

(contractholder payable), these cash flows offset each other in the table.

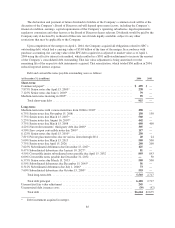

The estimated timing of the payment of the contractholder payables and the collection of contractholder

receivables for workers’ compensation policies is presented below:

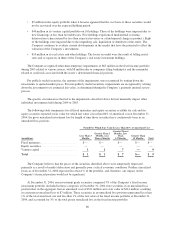

(in millions) Total

Less than 1

Year

1-3

Years

3-5

Years

After 5

Years

Contractholder payables/ receivables ........ $5,629 $1,222 $2,488 $934 $985

(3) The amounts in “Loss-based assessments” relate to estimated future payments of second-injury fund

assessments which would result from payment of current claim liabilities. Second injury funds cover the

cost of any additional benefits for aggravation of a pre-existing condition. For loss-based assessments, the

cost is shared by the insurance industry and self-insureds, funded through assessments to insurance

companies and self-insureds based on losses. Amounts relating to second-injury fund assessments are

included in “other liabilities” in the consolidated balance sheet.

(4) The amounts in “Reinsurance contracts accounted for as deposits” represent estimated future nominal

payments for reinsurance agreements that are accounted for as deposits. Amounts payable under deposit

agreements are included in “other liabilities” in the consolidated balance sheet. The amounts reported in the

table are presented on a nominal basis and have not been adjusted to reflect the time value of money.

Accordingly, the amounts above will differ from the Company’s balance sheet to extent that deposit values

in the balance sheet have been discounted using deposit accounting.

The above table does not include an analysis of liabilities reported for structured settlements for which the

Company has purchased annuities and remains contingently liable in the event of default by the company issuing

the annuity. The Company is not reasonably likely to incur future payment obligations under such agreements.

See note 9 of the Company’s consolidated financial statements for a further discussion.

Dividend Availability

The Company’s principal insurance subsidiaries are domiciled in the states of Connecticut and Minnesota.

The insurance holding company laws of both states applicable to the Company’s subsidiaries requires notice to,

and approval by, the state insurance commissioner for the declaration or payment of any dividend, that together

90