Travelers 2004 Annual Report Download - page 121

Download and view the complete annual report

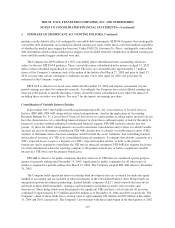

Please find page 121 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Reserves for losses and loss adjustment expenses on a statutory basis were $41.73 billion, $24.03 billion and

$23.28 billion at December 31, 2004, 2003 and 2002, respectively. The $17.70 billion increase in 2004 primarily

resulted from the merger with SPC and reserve charges recorded subsequent to the merger. Those reserve charges

included $928 million to strengthen asbestos reserves primarily as a result of the completion of the Company’s

annual asbestos liability review in the fourth quarter, $290 million to strengthen environmental reserves, reserve

adjustments related to the merger of $500 million for construction and $300 million for surety, $252 million

related to a specific construction contractor, $113 million related to the commutation of agreements with a major

reinsurer, and other net reserving actions.

The $749 million increase in reserves for losses and loss adjustment expenses on a statutory basis from

December 31, 2002 to December 31, 2003 was primarily due to business growth, and reserve strengthening at

Gulf which increased reserves by $521 million and American Equity which increased reserves by $115 million,

partially offset by asbestos and environmental net loss payments of $607 million.

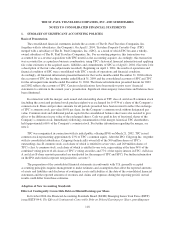

Prior to the IPO, TPC participated in Citigroup’s Capital Accumulation Plan (CAP) that provided for the

issuance of shares of Citigroup common stock in the form of restricted stock awards to eligible officers and other

key employees. On August 20, 2002, in connection with the Citigroup Distribution, the unvested outstanding

awards of restricted stock and deferred shares held by TPC employees on that date under Citigroup CAP awards

were cancelled and replaced by awards comprised primarily of 3 million newly issued shares of class A common

stock at a total market value of $53 million based on the closing price of the class A common stock on August

20, 2002. These replacement awards were granted on substantially the same terms, including vesting, as the

former Citigroup awards. The value of these newly issued shares along with class A and class B common stock

received in the Citigroup Distribution on the Citigroup restricted shares, were equal to the value of the cancelled

Citigroup restricted share awards. In addition the Board of Directors plan allows deferred receipt of shares of

class A common stock (deferred stock) to a future distribution date or upon termination of their service.

Prior to the Citigroup Distribution on August 20, 2002, unearned compensation expense associated with the

Citigroup restricted common stock grants is included in other assets in the consolidated balance sheet. Following

the Citigroup Distribution and the issuance of replacement stock awards in TPC’s class A and class B shares on

August 20, 2002, the unamortized unearned compensation expense associated with these awards is included as

unearned compensation in the consolidated balance sheet. Unearned compensation expense is recognized as a

charge to income ratably over the vesting period. The after-tax compensation cost charged to earnings for these

restricted stock and deferred stock awards was $26 million, $17 million and $17 million for the years ended

December 31, 2004, 2003 and 2002, respectively. See note 13 of notes to the Company’s consolidated financial

statements for a discussion of restricted common stock awards.

OTHER UNCERTAINTIES

For a discussion of other risks and uncertainties that could impact the Company’s results of operations or

financial condition, see note 17 of notes to the Company’s consolidated financial statements.

FUTURE APPLICATION OF ACCOUNTING STANDARDS

See note 1 of notes to the Company’s consolidated financial statements for a discussion of recently issued

accounting pronouncements.

FORWARD-LOOKING STATEMENTS

This report may contain, and management may make, certain “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of

historical facts, may be forward-looking statements. Specifically, the Company may make forward-looking

109