Travelers 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company has the option to defer interest payments on its convertible junior subordinated notes for a

period not exceeding 20 consecutive quarterly interest periods. If the Company elects to defer interest payments

on the notes, it will not be permitted, with limited exceptions, to pay dividends on its common stock during a

deferral period.

In February 2002, TPC paid a dividend of $1.00 billion to Citigroup in the form of a non-interest bearing

note payable on December 31, 2002. On December 31, 2002, this note was repaid in its entirety. Also in

February 2002, TPC paid an additional dividend of $3.70 billion to Citigroup in the form of a note payable in two

installments. This note was substantially prepaid following the offerings. The balance of $150 million was due on

May 9, 2004. This note was prepaid on May 8, 2002. In March 2002, TPC paid a dividend of $395 million to

Citigroup in the form of a note. This note was prepaid following the offerings.

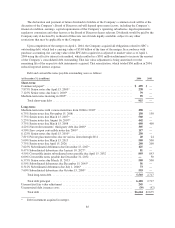

In March 2002, TPC issued $893 million aggregate principal amount of 4.5% convertible junior

subordinated notes which will mature on April 15, 2032, unless earlier redeemed, repurchased or converted.

Interest is payable quarterly in arrears. See note 10 of notes to the Company’s consolidated financial statements

for a further discussion.

In August 2002, CIRI issued $50 million aggregate principal amount of 6.0% convertible notes which were

to mature on December 31, 2032 unless earlier redeemed or repurchased. The Company repurchased these notes

in 2004. See note 10 of notes to the Company’s consolidated financial statements for further discussion.

In December 2002, TPC entered into a loan agreement with an unaffiliated lender and borrowed $550

million under a promissory note due in January 2004. The Promissory Note carried a variable interest rate of

LIBOR plus 25 basis points per annum. On February 5, 2003, TPC issued $550 million of Floating Rate Notes

due in February 2004. The proceeds from these notes were used to repay the $550 million due on the Promissory

Note. The Floating Rate Notes also carried a variable interest rate of LIBOR plus 25 basis points per annum. On

March 14, 2003 and June 17, 2003, the Company repurchased $75 million and $24 million, respectively, of the

Floating Rate Notes at par plus accrued interest. The remaining $451 million were repaid on September 5, 2003.

On March 11, 2003, TPC issued $1.40 billion of senior notes comprising $400 million of 3.75% senior notes

due March 15, 2008, $500 million of 5.00% senior notes due March 15, 2013 and $500 million of 6.375% senior

notes due March 15, 2033. The notes pay interest semi-annually on March 15 and September 15 of each year,

beginning September 15, 2003, are senior unsecured obligations and rank equally with all of TPC’s other senior

unsecured indebtedness. TPC may redeem some or all of the notes prior to maturity by paying a “make-whole”

premium based on U.S. Treasury rates. The net proceeds from the sale of these notes were contributed to its

primary subsidiary, TIGHI, so that TIGHI could prepay and refinance $500 million of 3.60% indebtedness to

Citigroup and to redeem $900 million aggregate principal amount of TIGHI’s 8.00% to 8.08% junior

subordinated debt securities held by subsidiary trusts. These trusts, in turn, used these funds to redeem $900

million of preferred capital securities on April 9, 2003.

These senior notes were sold to qualified institutional buyers as defined under Rule 144A under the

Securities Act of 1933 (the Securities Act) and outside the United States in reliance on Regulation S under the

Securities Act. Accordingly, the notes (the restricted notes) were not registered under the Securities Act or any

state securities laws and could not be transferred or resold except pursuant to certain exemptions. As part of this

offering, TPC agreed to file a registration statement under the Securities Act to permit the exchange of the notes

for registered notes (the Exchange Notes) having terms identical to those of the senior notes described above

(Exchange Offer). On April 14, 2003, TPC initiated the Exchange Offer pursuant to a Form S-4 that was filed

with the Securities and Exchange Commission. Accordingly, each series of Exchange Notes has been registered

under the Securities Act, and the transfer restrictions and registration rights relating to the restricted notes do not

apply to the Exchange Notes.

86