Travelers 2004 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

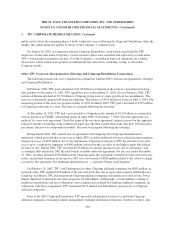

For periods prior to the April 1, 2004 merger completion date, segments have been restated from the

historical presentation of TPC to conform to the new segment presentation of the Company, where practicable.

As a result, prior period Bond and Construction results were reclassified from the historical TPC Commercial

Lines segment to the historical Specialty segment.

Invested and other assets and net investment income (NII) of historical TPC had been specifically identified

by reporting segment prior to the merger. Beginning in the second quarter of 2004, the Company developed a

methodology to allocate NII and invested assets to the identified segments. This methodology allocates pretax

NII based upon an investable funds concept, which takes into account liabilities (net of non-invested assets) and

appropriate capital considerations for each segment. The investment yield for investable funds reflects the

duration of the loss reserves’ future cash flows, the interest rate environment at the time the losses were incurred

and A+ rated corporate debt instruments. This duration yield will be compared to the average portfolio yield and

a new average yield will be determined. It is this average yield that will be used in the calculation of NII on

investable funds. Yields will be updated annually. Invested assets are allocated to segments in proportion to the

pretax allocation of NII. It is not practicable to apply this methodology to historical businesses and, as such,

actual (versus allocated) NII is included in revenues and operating income of the restated segments for periods

prior to the merger. The Company believes that the differences are not significant to a comparison with the new

segment presentation. It is also not practicable to present total assets for restated Commercial and Specialty

segments for periods prior to the merger.

The specific attributes of the Company’s four reportable business segments are as follows:

Commercial

The Commercial segment offers a broad array of property and casualty insurance and insurance-related

services to its clients. Commercial is organized into three marketing and underwriting groups, each of which

focuses on a particular client base and which collectively comprise Commercial’s core operations. The marketing

and underwriting groups include the following:

•Commercial Accounts serves primarily mid-sized businesses for casualty products and large and mid-

sized businesses for property products.

•Select Accounts serves small businesses and offers property, liability, commercial auto and workers’

compensation insurance.

•National Accounts provides casualty products and services to large companies, with particular emphasis

on workers’ compensation, general liability and automobile liability. National Accounts also includes

the Company’s residual market business, which primarily offers workers’ compensation products and

services to the involuntary market.

Commercial also includes the Special Liability Group (which manages the Company’s asbestos and

environmental liabilities); the reinsurance, health care, and certain international runoff operations; and policies

written by the Company’s wholly-owned subsidiary Gulf Insurance Company (Gulf), which was placed into

runoff during the second quarter of the year. These operations are collectively referred to as Commercial Other.

130