Travelers 2004 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued

of terrorism by the U.S. Secretary of Treasury. In the case of a war declared by Congress, only workers’

compensation losses are covered by the Terrorism Act. The Terrorism Act generally requires that all commercial

property casualty insurers licensed in the United States participate in the Program. The Program terminates on

December 31, 2005. Under the Program, a participating insurer is entitled to be reimbursed by the Federal

Government for 90% of subject losses, after an insurer deductible, subject to an annual cap. In each case, the

deductible percentage is applied to the insurer’s subject direct earned premiums from the calendar year

immediately preceding the applicable year. The deductible under the Program was 7% for 2003, 10% for 2004

and is 15% for 2005. The Program also contains an annual cap that limits the amount of aggregate subject losses

for all participating insurers to $100 billion. Once subject losses have reached the $100 billion aggregate during a

program year, there is no additional reimbursement from the U.S. Treasury and an insurer that has met its

deductible for the program year is not liable for any losses (or portion thereof) that exceed the $100 billion cap.

The Company’s estimated deductible under this federal program is $2.51 billion for 2005. The Company had no

terrorism-related losses in 2004 or 2003. If the Program is not renewed for periods after January 1, 2006, the

benefits of the Program will not be available to the Company, and the Company will be subject to losses from

acts of terrorism subject only to the terms and provisions of applicable policies.

2. MERGER AND ACQUISITION

Merger with SPC

On April 1, 2004, TPC merged with a subsidiary of SPC, as a result of which TPC became a wholly-owned

subsidiary of The St. Paul Travelers Companies, Inc. For accounting purposes, this transaction was accounted for

as a reverse acquisition with TPC treated as the accounting acquirer. Accordingly, this transaction was accounted

for as a purchase business combination, using TPC’s historical financial information and applying fair value

estimates to the acquired assets, liabilities and commitments of SPC as of April 1, 2004.

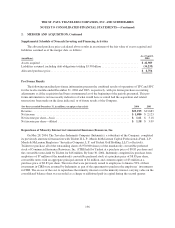

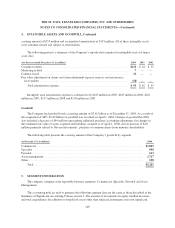

Determination of Purchase Price

The stock price used in determining the purchase price was based on an average of the closing prices of SPC

common stock for the two trading days before through the two trading days after SPC and TPC announced their

merger agreement on November 17, 2003. The purchase price also includes the fair value of the SPC stock

options, the fair value adjustment to SPC’s preferred stock, and other costs of the transaction. The purchase price

was approximately $8.76 billion, and was calculated as follows:

(in millions, except stock price per share)

Number of shares of SPC common stock outstanding as of April 1, 2004 ......................... 229.3

SPC’s average stock price for the two trading days before through the two trading days after November

17, 2003, the day SPC and TPC announced their merger .................................... $36.86

Fair value of SPC’s common stock ................................................... $8,452

Fair value of approximately 23 million SPC stock options ..................................... 186

Excess of fair value over book value of SPC’s convertible preferred stock outstanding, net of the excess

of the fair value over the book value of the related guaranteed obligation ....................... 100

Transaction costs of TPC ............................................................... 18

Purchase price ....................................................................... $8,756

133