Travelers 2004 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

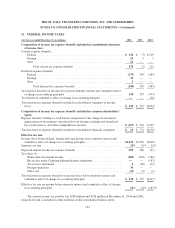

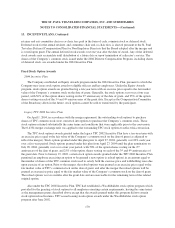

11. FEDERAL INCOME TAXES, Continued

For tax return purposes, as of December 31, 2004, the Company had NOL carryforwards that expire, if

unused, in 2017-2021 and foreign tax credit (FTC) carryforwards that expire, if unused, in 2009-2013. The

amount and timing of realizing the benefits of NOL and FTC carryforwards depend on future taxable income and

limitations imposed by tax laws. The approximate amounts of those NOLs on a regular tax basis and an

alternative minimum tax (AMT) basis were $2.09 billion and $276 million, respectively. The approximate

amounts of the FTCs both on a regular tax basis and an AMT basis were $27 million. The benefits of the NOL

and FTC carryforwards have been recognized in the consolidated financial statements.

U.S. income taxes have not been provided on $149 million of the Company’s foreign operations’

undistributed earnings as of December 31, 2004, as such earnings are intended to be permanently reinvested in

those operations. Furthermore, any taxes paid to foreign governments on these earnings may be used as credits

against the U.S. tax on any dividend distributions from such earnings.

Taxes on the GAAP basis in excess of tax basis of approximately $1.96 billion related to the Company’s

majority ownership of Nuveen Investments have not been recognized as of December 31, 2004. In January 2005,

the Company announced that it will explore strategic alternatives to divest its majority ownership position in

Nuveen Investments, which may result in a transaction that is tax-free, taxable, or some combination thereof.

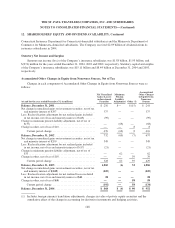

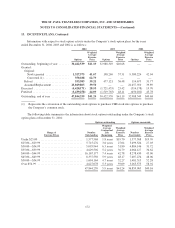

12. SHAREHOLDERS’ EQUITY AND DIVIDEND AVAILABILITY

Mandatorily Redeemable Securities of Subsidiary Trusts

TIGHI, in 1996, formed statutory subsidiary business trusts under the laws of the State of Delaware, which

issued Trust Securities representing undivided beneficial interests in the assets of the trust. The gross proceeds of

the Trust Securities were invested in Junior Subordinated Deferrable Interest Debentures (Junior Subordinated

Debentures) of its parent (TPC). On April 9, 2003, TIGHI redeemed the $900 million aggregate principal of the

TIGHI 8.00% to 8.08% Junior Subordinated Debentures held by the subsidiary trusts. The subsidiary trusts, in

turn, used these funds to redeem the $900 million liquidation value of the Trust Securities.

Preferred Stock

The Company’s preferred shareholders’ equity represents the par value of preferred shares outstanding that

the Company assumed in the merger related to The St. Paul Companies, Inc. Stock Ownership Plan (SOP) Trust,

less the remaining principal balance on the SOP Trust debt. The SOP Trust borrowed funds from a U.S.

underwriting subsidiary to finance the purchase of the preferred shares, and the Company guaranteed the SOP

debt.

The SOP Trust may at any time convert any or all of the preferred shares into shares of the Company’s

common stock at a rate of eight shares of common stock for each preferred share. The Board of Directors has

reserved a sufficient number of authorized common shares to satisfy the conversion of all preferred shares issued

to the SOP Trust and the redemption of preferred shares to meet employee distribution requirements. Upon the

redemption of preferred shares, the Company will issue shares of common stock to the trust to fulfill the

redemption obligations. See note 14.

Holders of preferred stock have a preference upon liquidation, dissolution or winding up of the Company of

$100 per share.

Common Stock

On April 1, 2004, each issued and outstanding share of TPC class A and class B common stock (including

the associated preferred stock purchase rights) was exchanged for 0.4334 of a share of the Company’s common

stock. See note 2.

166