Travelers 2004 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

10. DEBT, Continued

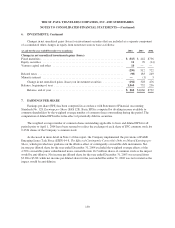

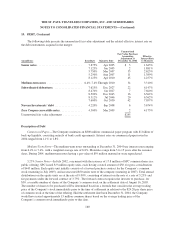

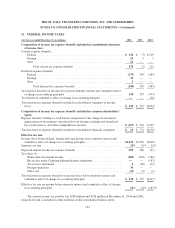

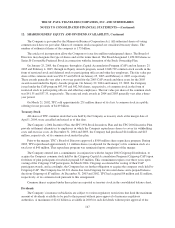

The following table presents the unamortized fair value adjustment and the related effective interest rate on

the debt instruments acquired in the merger:

(in millions) Issue Rate Maturity Date

Unamortized

Fair Value Purchase

Accounting

Adjustment at

December 31, 2004

Effective

Interest Rate

to Maturity

Senior notes ............................... 7.875% Apr 2005 $ 5 1.645%

7.125% Jun 2005 2 1.881%

5.750% Mar 2007 33 2.625%

5.250% Aug 2007 11 1.389%

8.125% Apr 2010 45 4.257%

Medium-term notes ........................ 6.4%-7.4% Through 2010 34 3.310%

Subordinated debentures ................... 7.625% Dec 2027 22 6.147%

8.470% Jan 2027 7 7.660%

8.500% Dec 2045 16 6.362%

8.312% Jul 2046 20 6.362%

7.600% Oct 2050 42 7.057%

Nuveen Investments’ debt ................... 4.220% Sep 2008 6 3.674%

Zero Coupon convertible notes ............... 4.500% Mar 2009 2 4.175%

Unamortized fair value adjustment ............. $245

Description of Debt

Commercial Paper—The Company maintains an $800 million commercial paper program with $1 billion of

back-up liquidity, consisting entirely of bank credit agreements. Interest rates on commercial paper issued in

2004 ranged from 1.1% to 2.8%.

Medium-Term Notes—The medium-term notes outstanding at December 31, 2004 bear interest rates ranging

from 6.4% to 7.4%, with a weighted average rate of 6.8%. Maturities range from 5 to 15 years after the issuance

dates. During 2004, medium-term notes having a par value of $59 million matured or were repurchased.

5.25% Senior Notes—In July 2002, concurrent with the issuance of 17.8 million of SPC common shares in a

public offering, SPC issued 8.9 million equity units, each having a stated amount of $50, for gross consideration

of $443 million. Each equity unit initially consists of a forward purchase contract for the Company’s common

stock (maturing in July 2005), and an unsecured $50 senior note of the company (maturing in 2007). Total annual

distributions on the equity units are at the rate of 9.00%, consisting of interest on the note at a rate of 5.25% and

fee payments under the forward contract of 3.75%. The forward contract requires the investor to purchase, for

$50, a variable number of shares of the Company’s common stock on the settlement date of August 16, 2005.

The number of shares to be purchased will be determined based on a formula that considers the average trading

price of the Company’s stock immediately prior to the time of settlement in relation to the $24.20 per share price

of common stock at the time of the offering. Had the settlement date been December 31, 2004, the Company

would have issued approximately 15 million common shares based on the average trading price of the

Company’s common stock immediately prior to that date.

160