Travelers 2004 Annual Report Download - page 49

Download and view the complete annual report

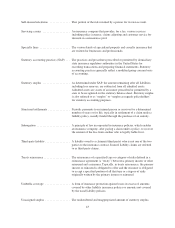

Please find page 49 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Glossary of Selected Insurance Terms

Accident year ...................... Theannual calendar accounting period in which loss events occurred,

regardless of when the losses are actually reported, booked or paid.

Adjusted unassigned surplus .......... Unassigned surplus as of the most recent statutory annual report

reduced by twenty-five percent of that year’s unrealized appreciation

in value or revaluation of assets or unrealized profits on investments,

as defined in that report.

Admitted insurer ................... Acompany licensed to transact insurance business within a state.

Annuity .......................... Acontract that pays a periodic benefit over the remaining life of a

person (the annuitant), the lives of two or more persons or for a

specified period of time.

Assigned risk pools ................. Reinsurance pools which cover risks for those unable to purchase

insurance in the voluntary market. Possible reasons for this inability

include the risk being too great or the profit being too small under the

required insurance rate structure. The costs of the risks associated

with these pools are charged back to insurance carriers in proportion

to their direct writings.

Assumed reinsurance ................ Insurance risks acquired from a ceding company.

Broker ........................... Onewhonegotiates contracts of insurance or reinsurance on behalf of

an insured party, receiving a commission from the insurer or reinsurer

for placement and other services rendered.

Capacity .......................... Thepercentage of surplus, or the dollar amount of exposure, that an

insurer or reinsurer is willing or able to place at risk. Capacity may

apply to a single risk, a program, a line of business or an entire book

of business. Capacity may be constrained by legal restrictions,

corporate restrictions or indirect restrictions.

Case reserves ...................... Loss reserves, established with respect to specific, individual reported

claims.

Casualty insurance .................. Insurance which is primarily concerned with the losses caused by

injuries to third persons, i.e., not the insured, and the legal liability

imposed on the insured resulting therefrom. It includes, but is not

limited to, employers’ liability, workers’ compensation, public

liability, automobile liability, personal liability and aviation liability

insurance. It excludes certain types of losses that by law or custom are

considered as being exclusively within the scope of other types of

insurance, such as fire or marine.

Catastrophe ....................... Asevere loss, resulting from natural and manmade events, including

risks such as fire, earthquake, windstorm, explosion, terrorism and

other similar events. Each catastrophe has unique characteristics.

Catastrophes are not predictable as to timing or amount in advance,

and therefore their effects are not included in earnings or claims and

claim adjustment expense reserves prior to occurrence.

37