Travelers 2004 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

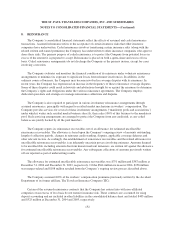

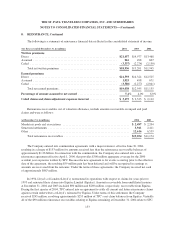

10. DEBT, Continued

will be convertible into shares of common stock at a conversion rate of 1.0808 shares of common stock for each

$57.68 principal amount of notes (equivalent to an initial conversion price of $53.37 per share of common stock),

subject to adjustment in certain events. On or after April 18, 2007, the notes may be redeemed at the Company’s

option. The Company is not required to make mandatory redemption or sinking fund payments with respect to

the notes. The notes are general unsecured obligations and are subordinated in right of payment to all existing

and future Senior Indebtedness. The notes are also effectively subordinated to all existing and future

indebtedness and other liabilities of any of the Company’s current or future subsidiaries.

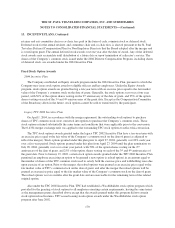

6.00% Convertible Notes—In August 2002, CIRI, a subsidiary of the Company, issued $50 million

aggregate principal amount of 6.0% convertible notes (the CIRI Notes) which were to mature on December 31,

2032 unless earlier redeemed or repurchased. Pursuant to a Purchase Agreement between Trident II L.P., Marsh

& McLennan Employees’ Securities Company, L.P., Marsh & McLennan Capital Professionals Fund, L.P.,

Trident Gulf Holding, LLC and The Travelers Indemnity Company (Indemnity), Indemnity agreed to purchase

the aggregate principal amount of the CIRI Notes. This transaction was finalized in May 2004.

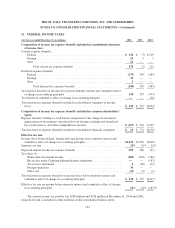

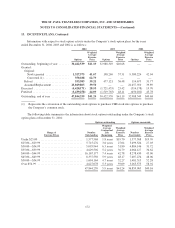

Maturities—The amount of debt obligations, other than commercial paper, that become due in each of the

next five years is as follows: 2005, $420 million; 2006, $210 million; 2007, $1.02 billion; 2008, $857 million;

and 2009, $119 million.

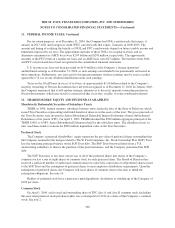

Line of Credit Agreements

Effective April 17, 2003, TPC entered into the following line of credit agreements with Citibank, a

subsidiary of Citigroup, TPC’s former parent: (i) a $250 million 45-month revolving line of credit (the 45-Month

Line of Credit), and (ii) a $250 million 364-day revolving line of credit (the TPC 364-Day Line of Credit and,

together with the 45-Month Line of Credit, the TPC Lines of Credit). TPC may, with Citibank’s consent, extend

the commitment of the 364-day Line of Credit for additional 364-day periods under the same terms and

conditions. TPC has the option, provided there is no default or event of default, to convert outstanding advances

under the 364-Day Line of Credit at the commitment termination date to a term loan maturing no later than one

year from the commitment termination date.

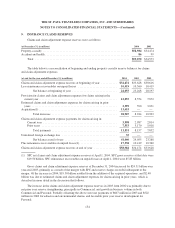

Prior to the merger, SPC was party to the following line of credit agreements with a syndicate of banks: (i) a

$330 million 364-day revolving line of credit (the SPC 364-Day Line of Credit), and (ii) a $270 million 5-year

revolving line of credit (the 5-Year Line of Credit and, together with the SPC 364-Day Line of Credit, the SPC

Lines of Credit). SPC may, with bank syndicate consent, extend the commitment of the SPC 364-day Line of

Credit for additional 364-day periods under the same terms and conditions.

As a result of the expiration of the SPC 364-Day Line of Credit and the TPC 364-Day Line of Credit, the

Company entered into a new $480 million 364-day revolving line of credit agreement (the STA 364-Day Line of

Credit) with a syndicate of banks. As of December 31, 2004, the Company has access to the following bank

credit lines: (i) the $250 million 45-Month Line of Credit, (ii) the $270 million 5-Year Line of Credit, and (iii)

the $480 million STA 364-Day Line of Credit (collectively, the Company Line of Credit). The Company Line of

Credit supports the Company’s commercial paper program.

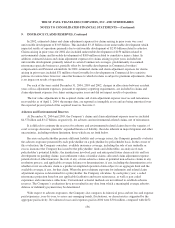

Borrowings under the Company Line of Credit may be made, at the Company’s option, at a variable interest

rate equal to either the lender’s base rate plus an applicable margin or at LIBOR plus an applicable margin. The

Company Line of Credit includes a commitment fee and, for any date on which advances exceed 50% of the total

162