Travelers 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

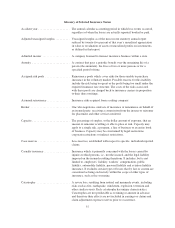

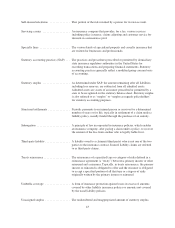

National Association of Insurance

Commissioners (NAIC) ............ Anorganization of the insurance commissioners or directors of all 50

states and the District of Columbia organized to promote consistency

of regulatory practice and statutory accounting standards throughout

the United States.

Net written premiums ............... Direct written premiums plus assumed reinsurance premiums less

premiums ceded to reinsurers.

Operating income (loss) ............. Netincome (loss) excluding the after-tax impact of net realized

investment gains (losses) and cumulative effect of changes in

accounting principles when applicable.

Operating income (loss) per share ...... Netincome (loss) excluding the after-tax impact of net realized

investment gains (losses) on a per share basis.

Operating return on equity ........... Theratio of operating income to average equity excluding net

unrealized gains or losses on investment securities, net of tax.

Personal lines ...................... Thevarious kinds of property and casualty insurance that are written

for individuals or families.

Pool ............................. Anorganization of insurers or reinsurers through which particular

types of risks are underwritten with premiums, losses and expenses

being shared in agreed-upon percentages.

Premiums ......................... Theamount charged during the year on policies and contracts issued,

renewed or reinsured by an insurance company.

Producer ......................... Contractual entity which directs insureds to the insurer for coverage.

This term includes agents and brokers.

Property insurance .................. Insurance that provides coverage to a person or business with an

insurable interest in tangible property for that person’s or business’s

property loss, damage or loss of use.

Quota share reinsurance ............. Reinsurance wherein the insurer cedes an agreed-upon fixed

percentage of liabilities, premiums and losses for each policy covered

on a pro rata basis.

Rates ............................ Amounts charged per unit of insurance.

Reinsurance ....................... Thepractice whereby one insurer, called the reinsurer, in

consideration of a premium paid to that insurer, agrees to indemnify

another insurer, called the ceding company, for part or all of the

liability of the ceding company under one or more policies or

contracts of insurance which it has issued.

Reinsurance agreement .............. Acontract specifying the terms of a reinsurance transaction.

41