Travelers 2004 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

14. PENSION PLANS, RETIREMENT BENEFITS AND SAVINGS PLANS, Continued

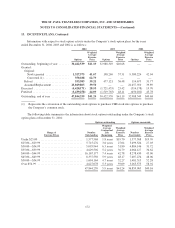

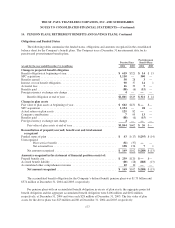

Weighted average target asset allocations at December 31, 2004 by asset category were as follows:

Asset Category

Plan

Assets

Equity securities .................................................... 30–70%

Debt securities ...................................................... 30–70%

Cash .............................................................. 0–10%

Other ............................................................. 0–10%

Equity securities include 797,600 shares of the Company’s common stock with a market value of $30

million at December 31, 2004.

The Company’s other post-retirement benefit plan weighted-average asset allocations at December 31, 2004

by asset category were as follows:

Asset Category 2004

Debt securities ......................................................... 84%

Cash................................................................. 16%

Estimated Future Benefit Payments

Benefits expected to be paid, which reflect estimated future employee service, are estimated to be:

Expected payments by period (in millions) Pension Plans

Postretirement

Benefit Plans

2005 ............................................. $68 $20

2006 ............................................. 77 19

2007 ............................................. 84 20

2008 ............................................. 95 21

2009 ............................................. 103 21

2010 through 2014 .................................. 596 114

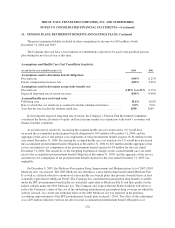

401(k) Savings Plan

The Company has a 401(k) savings plan under which substantially all legacy TPC employees and Company

employees hired after April 1, 2004, are eligible to participate. In 2004, the Company matched employee

contributions up to 5% of eligible pay but not more than $2,500 annually. Prior to 2004, the Company matched

employee contributions up to 3% of eligible pay but not more than $1,500 annually. The expense related to this

plan was $34 million, $20 million and $17 million for the years ended December 31, 2004, 2003 and 2002,

respectively.

Savings Plus and Stock Ownership Plans

In connection with the merger, the Company assumed The St. Paul Companies, Inc. Savings Plus Plan

(SPP), a 401(k) savings plan and The St. Paul Companies, Inc. Stock Ownership Plan (SOP). Substantially all

employees who were hired by legacy SPC before April 1, 2004 are eligible to participate in these plans. In 2004

under the SPP, the Company matched 100% of employees’ contributions up to a maximum of 6% of their salary.

The match was in the form of preferred shares, to the extent available in the SOP, or in the Company’s common

shares. Also allocated to participants were preferred shares equal to the value of dividends on previously

allocated shares.

180