Travelers 2004 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

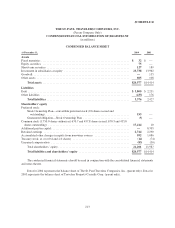

SCHEDULE II

THE ST. PAUL TRAVELERS COMPANIES, INC.

(Parent Company Only)

CONDENSED FINANCIAL INFORMATION OF REGISTRANT

(in millions)

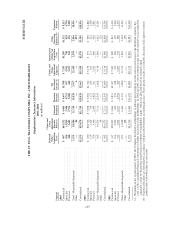

CONDENSED STATEMENT OF CASH FLOWS

For the period ended December 31,* 2004 2003 2002

Cash flows from operating activities

Net income (loss) ............................................................. $ 955 $ 1,696 $ (27)

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Equity in net (income) loss of subsidiaries ...................................... (1,100) (1,761) 478

Dividends received from consolidated subsidiaries ............................... 1,880 761 60

Capital contributed to subsidiaries ............................................ (940) (1,445) —

Deferred federal income tax benefit (expense) ................................... 259 67 (93)

Income taxes receivable (payable) ............................................ (389) (36) (6)

Recoveries from former affiliate .............................................. —361 58

Net transfer of pension asset and post-retirement liability .......................... (247) ——

Other ................................................................... 12 31 34

Net cash provided by (used in) operating activities ............................. 430 (326) 504

Cash flows from investing activities

Short-term securities, (purchases) sales, net ......................................... (87) (180) 143

Other investments, net .......................................................... 20 — 403

Net cash provided by (used in) investing activities .............................. (67) (180) 546

Cash flows from financing activities

Issuance of debt ............................................................... 302 1,382 1,417

Payment of debt ............................................................... (173) (550) —

Payment of note to former affiliate ................................................ —— (6,299)

Initial public offering .......................................................... —— 4,090

Treasury stock purchased ....................................................... —(40) —

Treasury stock acquired—net employee stock-based compensation ...................... (1) (18) (4)

Issuance of common stock-employee stock options ................................... 68 40 10

Dividends to shareholders ....................................................... (561) (282) —

Dividends to former affiliate ..................................................... —— (158)

Receipts from former subsidiaries ................................................. —— 158

Payment of dividend on subsidiary’s preferred stock .................................. —(5) (2)

Transfer of employee benefit obligations to former affiliates ............................ —(22) (172)

Transfer of lease obligations to former affiliate ...................................... —— (88)

Other ....................................................................... 19 ——

Net cash provided by (used in) financing activities ............................. (346) 505 (1,048)

Net increase (decrease) in cash ................................................... 17 (1) 2

Cash at beginning of period ..................................................... —2—

Cash at end of period ......................................................... $17$1$2

Supplemental disclosure of cash flow information

Cash received during the year for taxes ............................................ 219 $85 24

Cash paid during the year for interest .............................................. $ 142 $82$22

* Data for 2004 represents results of The St. Paul Travelers Companies, Inc. (parent company only) for the

nine-month period from the merger date of April 1, 2004 through December 31, 2004. Data for prior periods

represents historical data for Travelers Property Casualty Corp. (parent company only) for the twelve

months ended December 31, 2003 and 2002.

The condensed financial statements should be read in conjunction with the consolidated financial statements

and notes thereto.

214