Travelers 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

levels also declined substantially. In Bond, the repositioning of the book of business was primarily centered in

the SPC business acquired in the merger.

Net written premiums in 2004 in the majority of the Company’s remaining domestic specialty businesses

were strong, with retention levels at or above historical levels. The Company continued to focus on retaining the

profitable and well-priced book of business that has been built in recent years. Renewal price change increases in

these operations moderated throughout the year to the upper single-digit level. New business levels in 2004 were

down compared with 2003, when renewal rights transactions contributed to strong growth in new business. The

impact of the decline in new business levels in 2004 was partially offset by premium growth resulting from the

transfer of certain business from the Company’s Gulf operation, which was placed in runoff in the second quarter

of the year. In addition, premium volume in these domestic businesses benefited in 2004 from a small amount of

additional transfers of certain business previously written in the Commercial segment’s commercial accounts

operation.

In International Specialty, acquired in the merger, business retention levels (excluding Lloyd’s) were strong

relative to pre-merger levels. New business levels were consistent with 2003, while the rate of renewal price

change increases moderated to the low—single digit levels. The Company continued to focus on retaining its

profitable book of existing international specialty business. At Lloyd’s, premium volume was negatively

impacted by the planned non-renewal of certain personal lines insurance coverages.

The $218 million, or 21%, increase in net written premiums in 2003 over 2002 reflected a favorable

premium rate environment and strong new business, particularly in Bond’s executive liability lines.

Personal

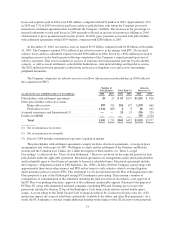

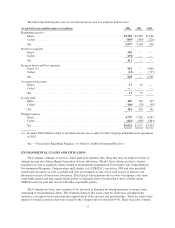

Results of the Company’s Personal segment were as follows:

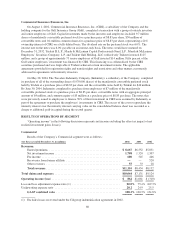

(for the year ended December 31, in millions) 2004 2003 2002

Revenues:

Earned premiums .................................................. $5,580 $4,822 $4,354

Net investment income .............................................. 442 361 385

Other revenues .................................................... 91 85 80

Total revenues .................................................... $6,113 $5,268 $4,819

Total claims and expenses .............................................. $4,732 $4,555 $4,329

Operating income ..................................................... $ 939 $ 492 $ 347

Loss and loss adjustment expense ratio ..................................... 58.3% 69.1% 73.6%

Underwriting expense ratio .............................................. 24.9 23.7 24.0

GAAP combined ratio ............................................. 83.2% 92.8% 97.6%

Operating income of $939 million in 2004 increased $447 million over 2003. The significant improvement

in 2004 was driven by historically low loss frequency levels, particularly in the property line, after-tax favorable

prior year reserve development of $246 million, an increase in investment income, and strong premium growth

reflecting the impact of unit growth and price increases.

The $758 million, or 16%, growth in earned premiums over 2003 was primarily due to an increase in

organic new business volume, new business associated with the Royal & SunAlliance renewal rights transaction

completed in the third quarter of 2003, continued strong business retention levels and renewal price increases.

Net investment income in 2004 grew 22% over 2003, driven by strong operational cash flows during the year that

contributed to a significant growth in invested assets since the end of 2003. In addition, net investment income in

2004 benefited from $39 million of income resulting from the initial public trading of an investment in the first

68