Reebok 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Group Management Report – Our Group

48

2014

Group Strategy

/

02.1

/

Focusing on sustainability

Like any global business, the adidas Group must manage wide-ranging commercial and competitive

pressure to deliver increased financial returns and growth. At the same time, we are accountable

for our employees and have a high degree of responsibility towards the workers in our suppliers’

factories and also for the environment. We are committed to striking the balance between

shareholder interests and the needs and concerns of employees and workers, as well as the

environment. We report publicly on the steps we take to have a more positive impact on society and

the planet on our website.

Creating long-term shareholder value

Creating long-term value for our shareholders through strong and consistent operating cash flow

generation drives our overall decision-making process. Therefore, we are focused on rigorously

managing those factors under our control, making strategic choices that will drive sustainable

revenue and earnings growth, and ultimately operating cash flow. Across our operations, we pursue

in particular the avenues for growth which we expect to be most value-enhancing, with particular

emphasis on improving brand strength and Group profitability. In addition, rigorously managing

working capital and optimising our capital structure remain key priorities for us. Furthermore,

we are committed to increasing returns to shareholders with above-industry-average share price

performance and dividends.

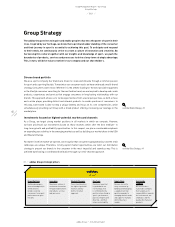

adidas Group new strategic goals to be announced in 2015

In November 2010, the Group unveiled its 2015 strategic business plan named ‘Route 2015’, which

defined strategies and objectives for the period up to 2015. Since its introduction, the plan has

resulted in significant improvements in many of our business areas. We have, for example, already

over-achieved our target of increasing the share of revenues from controlled space activities to

more than 45% by 2015. In addition, we have multiplied our eCommerce business over the last

couple of years and are well on track to achieving the targeted sales level of € 500 million through

this channel by 2015. We have also successfully expanded our fast fashion adidas NEO label,

increasing revenues for this sub-brand to over € 800 million in 2014 and building valuable expertise

in a vertical business model. Additionally, we have significantly reduced complexity on a Group level

by streamlining the global product range, consolidating our warehouse base as well as harmonising

above-market service. Furthermore, our Global Operations function has been very successful in

establishing in-season product creation capabilities and in significantly reducing lead times for

both footwear and apparel. These achievements have set new standards with regard to productivity,

efficiency and flexibility within our supply chain.

In 2014, however, mainly due to the continued weakness in the golf market, negative economic

developments in Russia/CIS as well as ongoing currency headwinds, the Group postponed the

delivery of its top- and bottom-line Route 2015 targets. As a result, the Group has been undergoing a

thorough review of its strategic priorities and organisational set-up throughout 2014 and early 2015.

In a first step, to strengthen brand leadership as well as drive faster decision-making and more

effective and efficient consumer-focused strategies and execution in the marketplace, Management

initiated a reorganisation of the Global Brands and Global Sales structures. The Group will release

the full details on its updated strategies at the end of March 2015.

see Sustainability, p. 89

www.adidas-group.com

see Internal Group Management System, p. 98

see Our Share, p. 38

see Glossary, p. 258