Reebok 2014 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

223

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

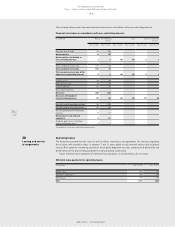

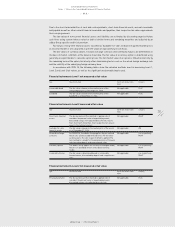

Convertible Bond

On March 14, 2012, the Executive Board, with the approval of the Supervisory Board, made partial use of the

authorisation of the Annual General Meeting from May 6, 2010, and on March 21, 2012 issued a convertible bond

due on June 14, 2019 in a nominal value of € 500 million via an offer to institutional investors outside the USA

excluding shareholders’ subscription rights. In principle, the conversion rights are exercisable between May 21,

2012 and June 5, 2019, subject to lapsed conversion rights as set out under § 6 section 3 or to the excluded periods

as defined by § 6 section 4 of the bond terms and conditions, and (subject to an adjustment to the conversion

rights resulting from the dilution adjustment regulations set out under § 10 or a change of control in accordance

with § 13 of the bond terms and conditions) are convertible into 6,056,447 shares of the company. The conversion

price currently amounts to € 82.56 per share. The convertible bond bears an interest rate of 0.25% per annum.

Bondholders are entitled to demand early redemption of the bonds as of June 14, 2017. As of July 14, 2017,

adidas AG may conduct an early redemption of the bond, if, on 20 of 30 consecutive trading days, the share price

of adidas AG exceeds the current conversion price of € 82.56 by at least 30%. The bonds are listed on the Open

Market segment of the Frankfurt Stock Exchange.

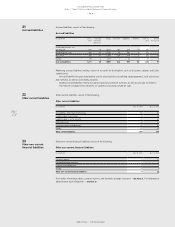

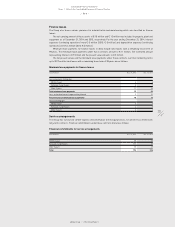

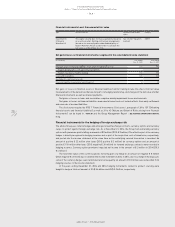

Repurchase of adidas AG shares

The authorisation of the Executive Board to repurchase treasury shares, which was granted by the Annual General

Meeting on May 6, 2010 and which was not utilised, was cancelled by the Annual General Meeting on May 8, 2014.

At the same time, the Annual General Meeting granted the Executive Board a new authorisation to repurchase

treasury shares up to an amount totalling 10% of the nominal capital until May 7, 2019. The authorisation may be

used by the company but also by its subordinated Group companies or by third parties on account of the company

or its subordinated Group companies or third parties assigned by the company or one of its subordinated Group

companies.

Based on the authorisation to repurchase treasury shares granted by the Annual General Meeting on May 8,

2014, the adidas AG Executive Board commenced a share buyback programme on November 7, 2014. The

repurchased shares may either be cancelled (capital reduction) or else be used to meet obligations arising from

the potential conversion of the company’s € 500 million convertible bond due on June 14, 2019.

In November 2014, 1,881,836 shares were repurchased at an average price of € 62.89, corresponding

to a notional amount of € 1,881,836 in the nominal capital and consequently 0.90% of the nominal capital. In

December 2014, 3,007,306 shares were repurchased at an average price of € 60.41, corresponding to a notional

amount of € 3,007,306 in the nominal capital and consequently 1.44% of the nominal capital. Under the granted

authorisation, adidas AG repurchased a total of 4,889,142 shares for a total price of € 299,999,987 (excluding

incidental purchasing costs), i.e. for an average price of € 61.36 per share, in a first tranche between November 7,

2014 and December 12, 2014 inclusive. On December 12, 2014, the first tranche of the share buyback programme

was concluded. The company reserves the right to continue with or to resume the share buyback programme in

the future in alignment with the published parameters. For details

/

SEE DISCLOSURES PURSUANT TO § 315 SECTION 4 AND

§ 289 SECTION 4 OF THE GERMAN COMMERCIAL CODE, P. 131.

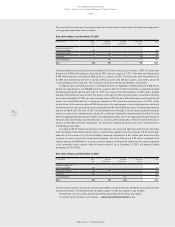

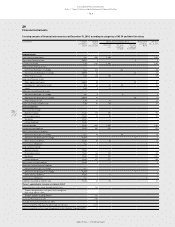

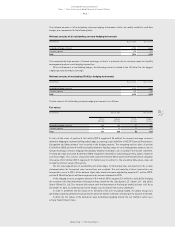

Changes in the percentage of voting rights

Pursuant to § 160 section 1 no. 8 AktG, existing shareholdings which have been notified to the company in

accordance with § 21 section 1 or section 1a of the German Securities Trading Act (Wertpapierhandelsgesetz –

WpHG) need to be disclosed.

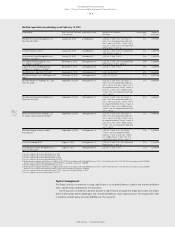

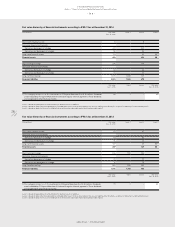

The following table reflects shareholdings reportable as at February 13, 2015 which have been notified to the

company. The respective details are taken from the most recent voting rights notification received by the company.

All voting rights notifications disclosed by the company in the year under review and up to and including February

13, 2015 are available on the adidas Group website

/

WWW.ADIDAS-GROUP.COM/S/VOTING-RIGHTS-NOTIFICATIONS. The

details on the percentage of shareholdings and voting rights may no longer be up to date.