Reebok 2014 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

217

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

The Group has recognised post-employment benefit obligations arising from defined benefit plans. The benefits

are provided pursuant to the legal, fiscal and economic conditions in each respective country and mainly depend

on the employees’ years of service and remuneration.

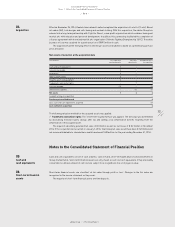

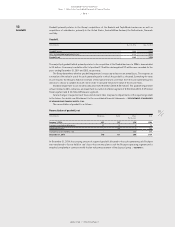

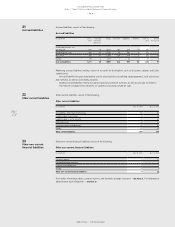

Pensions and similar obligations

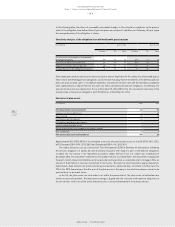

(€ in millions) Dec. 31, 2014 Dec. 31, 2013

Liability arising from defined benefit pension plans 271 243

Similar obligations 14 12

Pensions and similar obligations 284 255

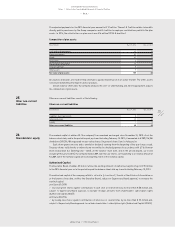

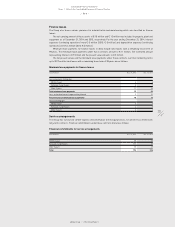

Defined contribution pension plans

The total expense for defined contribution plans amounted to € 46 million in 2014 (2013: € 47 million).

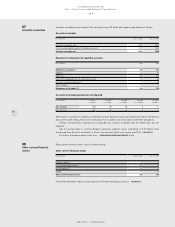

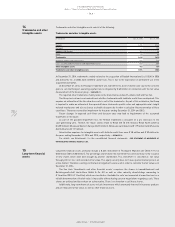

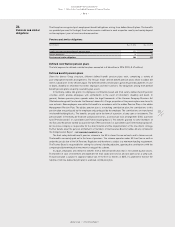

Defined benefit pension plans

Given the diverse Group structure, different defined benefit pension plans exist, comprising a variety of

post-employment benefit arrangements. The Group’s major defined benefit pension plans relate to adidas AG

and its subsidiaries in the UK and Japan. The defined benefit pension plans generally provide payments in case

of death, disability or retirement to former employees and their survivors. The obligations arising from defined

benefit pension plans are partly covered by plan assets.

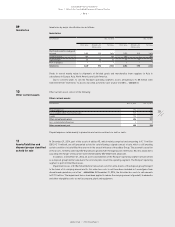

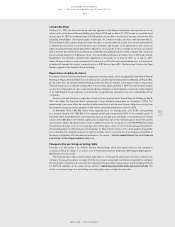

In Germany, adidas AG grants its employees contribution-based and final salary defined benefit pension

schemes, which provide employees with entitlements in the event of retirement, disability and death. In

general, German pension plans operate under the legal framework of the German Company Pensions Act

(‘Betriebsrentengesetz’) and under the German Labour Act. A large proportion of the pension plans are closed to

new entrants. New employees are entitled to benefits in accordance with the adidas Pension Plan or the adidas

Management Pension Plan. The adidas pension plan is a matching contribution plan; the contributions to this

pension plan are partly paid by the employee and partly paid by the employer. The contributions are transferred

into benefit building blocks. The benefits are paid out in the form of a pension, a lump sum or instalments. The

pension plans in Germany are financed using book reserves, a contractual trust arrangement (CTA), a pension

fund (‘Pensionsfonds’) or a provident fund (‘Unterstützungskasse’). The benefits granted to some members of

the Executive Board are funded via a pension fund (‘Pensionsfonds’) or a provident fund (‘Unterstützungskasse’).

An insurance company is responsible for the determination and the implementation of the investment strategy.

Further details about the pension entitlements of members of the Executive Board of adidas AG are contained in

the Compensation Report

/

SEE COMPENSATION REPORT, P. 28.

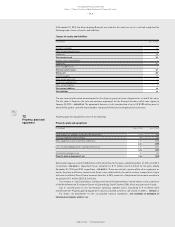

The final salary defined benefit pension scheme in the UK is closed to new entrants and to future accrual.

The benefits are mainly paid out in the form of pensions. The scheme operates under UK trust law as well as

under the jurisdiction of the UK Pensions Regulator and therefore is subject to a minimum funding requirement.

The Trustee Board is responsible for setting the scheme’s funding objective, agreeing the contributions with the

company and determining the investment strategy of the scheme.

In Japan, employees are entitled to benefits from a defined benefit plan that is not funded by plan assets.

The benefits in case of retirement are dependent on final salary and service, and are paid out as a lump sum.

The pension plan is subject to Japanese labour law. In the first six months of 2015, it is planned to transfer the

liabilities from the defined benefit plan to a defined contribution plan.

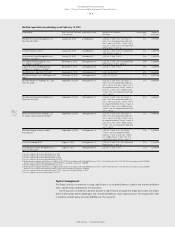

24

Pensions and similar

obligations