Reebok 2014 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

201

2014

Notes

/

04.8

/

Land leases are measured at the lower of the fair value or the present value of minimum lease payments and are

depreciated on a straight-line basis over the contractually agreed lease term.

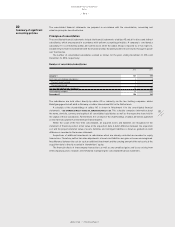

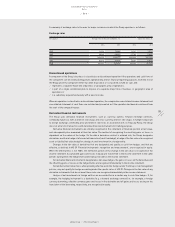

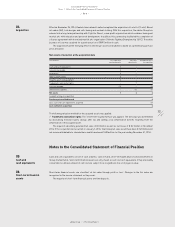

Estimated useful lives are as follows:

Estimated useful lives of property, plant and equipment

Years

Land indefinite

Land leases 99

Buildings and leasehold improvements 20 – 50 1)

Technical equipment and machinery as well as other equipment and furniture and fixtures 2 – 10

1) Or, if shorter, the lease term/useful life (see Note 28).

Expenditures for repairs and maintenance are expensed as incurred. Renewals and improvements are capitalised

and depreciated separately, if the recognition criteria are met.

Impairment losses

If facts and circumstances indicate that non-current assets (e.g. property, plant and equipment, intangible assets

including goodwill and certain financial assets) might be impaired, the recoverable amount is determined. It is

measured at the higher of its fair value less costs to sell and value in use. Non-financial instruments measured

at the recoverable amount primarily relate to impaired property, plant and equipment being measured at

Level 3 according to IFRS 13 ‘Fair Value Measurement’ and taking unobservable inputs (e.g. profit or cash flow

planning) into account. The recoverable amount for furniture and fixtures in own-retail stores is calculated using

the discounted cash flow method as part of determining the profitability of the respective own-retail stores. An

impairment loss is recognised in other operating expenses or reported in goodwill impairment losses if the

carrying amount exceeds the recoverable amount. If there is an impairment loss for a cash-generating unit, first

the carrying amount of any goodwill allocated to the cash-generating unit is reduced. Subsequently, provided that

the recoverable amount is lower than the carrying amount, the other non-current assets of the unit are reduced

pro rata on the basis of the carrying amount of each asset in the unit.

Irrespective of whether there is an impairment indication, intangible assets with an indefinite useful life and

goodwill acquired in business combinations are tested annually for impairment.

An impairment loss recognised in goodwill is not reversible. With respect to all other impaired assets, an

impairment loss recognised in prior periods is reversed affecting the income statement if there has been a change

in the estimates used to determine the recoverable amount. An impairment loss is reversed only to the extent

that the asset’s carrying amount does not exceed the carrying amount that would have been determined (net of

depreciation or amortisation) if no impairment loss had been recognised.

Leases

Under finance lease arrangements, the substantial risks and rewards associated with an asset are transferred

to the lessee. At the beginning of the lease arrangement, the respective asset and a corresponding liability are

recognised at the fair value of the asset or, if lower, the net present value of the minimum lease payments.

For subsequent measurement, minimum lease payments are apportioned between the finance expense and the

reduction of the outstanding liability. The finance expense is allocated to each period during the lease term so as

to produce a constant periodic interest rate on the remaining balance of the liability. In addition, depreciation and

any impairment losses for the associated assets are recognised. Depreciation is performed over the lease term

or, if shorter, over the useful life of the asset.

Under operating lease agreements, rent expenses are recognised on a straight-line basis over the term of

the lease.