Reebok 2014 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

220

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

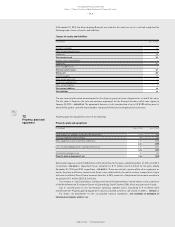

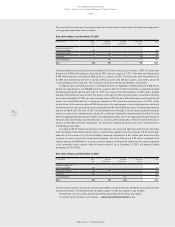

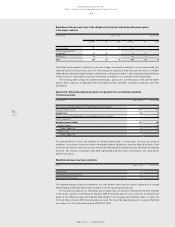

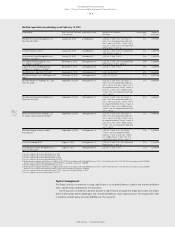

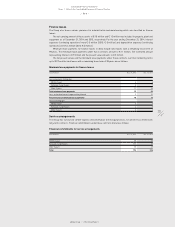

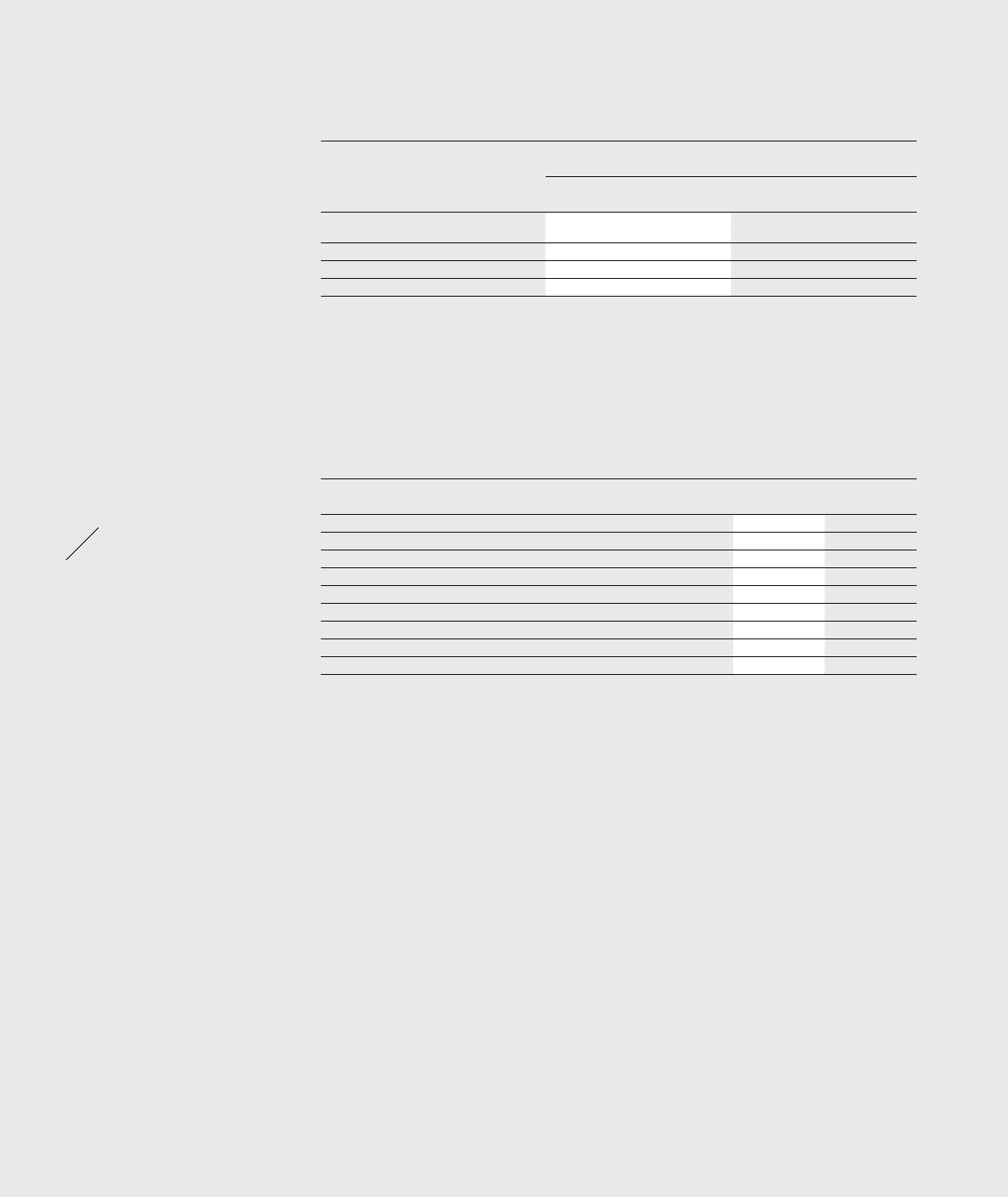

In the following table, the effects of reasonably conceivable changes in the actuarial assumptions on the present

value of the obligation from defined benefit pension plans are analysed. In addition, for Germany, UK and Japan

the average duration of the obligation is shown.

Sensitivity analysis of the obligation from defined benefit pension plans

(€ in millions) Dec. 31, 2014 Dec. 31, 2013

Germany UK Japan Germany UK Japan

Present value of the obligation from defined

benefit pension plans 305 54 15 224 41 14

Increase in the discount rate by 0.5% 279 47 14 207 35 13

Reduction in the discount rate by 0.5% 335 63 16 243 47 15

Average duration of the obligations (in years) 18 30 12 16 30 12

Since many pension plans are closed to future accrual or are not dependent on the salary, the salary trend plays a

minor role in determining pension obligations. Due to the fact that about half of the benefits of the German pension

plans are paid as lump sums or instalment payments, the pension increase rate and the mortality assumption

have significantly less impact than the discount rate when calculating the pension obligations. In Germany, the

pension increase rate was reduced to 1.5% as at December 31, 2014 (2013: 2%). This resulted in a decrease in the

present value of the pension obligations by € 10 million as at December 31, 2014.

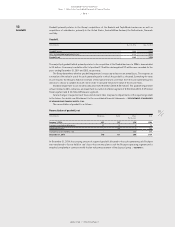

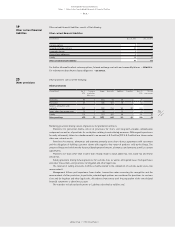

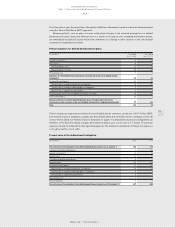

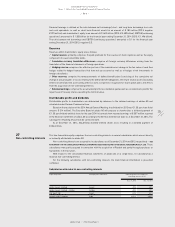

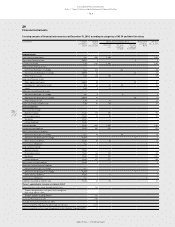

Fair value of plan assets

(€ in millions) 2014 2013

Fair value of plan assets at January 1 83 76

Currency translation differences 4 (2)

Pensions paid (5) (2)

Contributions by the employer 68 5

Contributions paid by plan participants 0 0

Interest income from plan assets 4 3

Return on plan assets (not included in net interest income) 1 3

Plan settlements 0 0

Fair value of plan assets at December 31 157 83

Approximately 90% (2013: 83%) of the total plan assets are allocated to plan assets in the UK (2014: 26%, 2013:

44%), Germany (2014: 59%, 2013: 30%) and Switzerland (2014: 4%, 2013: 9%).

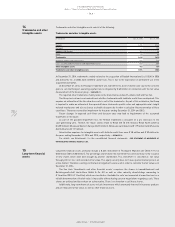

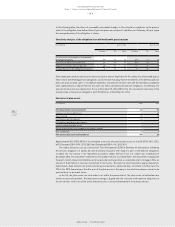

The adidas Group has set up a Contractual Trust Arrangement (CTA) in Germany for the purpose of funding

the pension obligations of adidas AG and insolvency insurance with regard to part of the pension obligations

of adidas AG. The trustee is the registered association ‘adidas Pension Trust e.V.’, which was established in

December 2013. The investment committee of the adidas Pension Trust determines the investment strategy with

the goal to match the pension liabilities as far as possible and to generate a sustainable return. In August 2014, an

amount of € 65 million in cash was transferred to the trustee. The cash has been invested in equity index funds,

hybrid bonds, fixed interest rate bonds and money market funds. adidas AG does not intend to further fund the

CTA in the 2015 financial year. Another part of the plan assets in Germany is invested in insurance contracts via

pension funds or provident funds.

In the UK, the plan assets are held under trust within the pension fund. The plan assets in Switzerland are

held by a pension foundation. The investment strategy is aligned with the structure of the pension obligations in

these countries. In the rest of the world, the plan assets consist predominantly of insurance contracts.