Reebok 2014 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

Group Management Report – Financial Review

177

2014

/

03.5

/

adidas Group

/

2014 Annual Report

Risk and Opportunity Report

/

Financial Risks

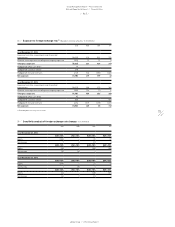

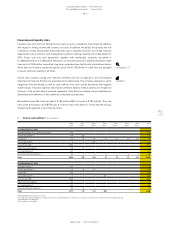

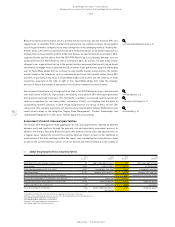

Financing and liquidity risks

Liquidity risks arise from not having the necessary resources available to meet maturing liabilities

with regard to timing, volume and currency structure. In addition, the adidas Group faces the risk

of having to accept unfavourable financing terms due to liquidity restraints. Our Group Treasury

department uses an efficient cash management system to manage liquidity risk. At December 31,

2014, Group cash and cash equivalents together with marketable securities amounted to

€ 1.688 billion (2013: € 1.629 billion). Moreover, our Group maintains € 1.520 billion bilateral credit

lines and a € 500 million committed long-term syndicated loan facility with international banks,

which does not include a market disruption clause. The € 2.020 billion in credit lines are designed

to ensure sufficient liquidity at all times.

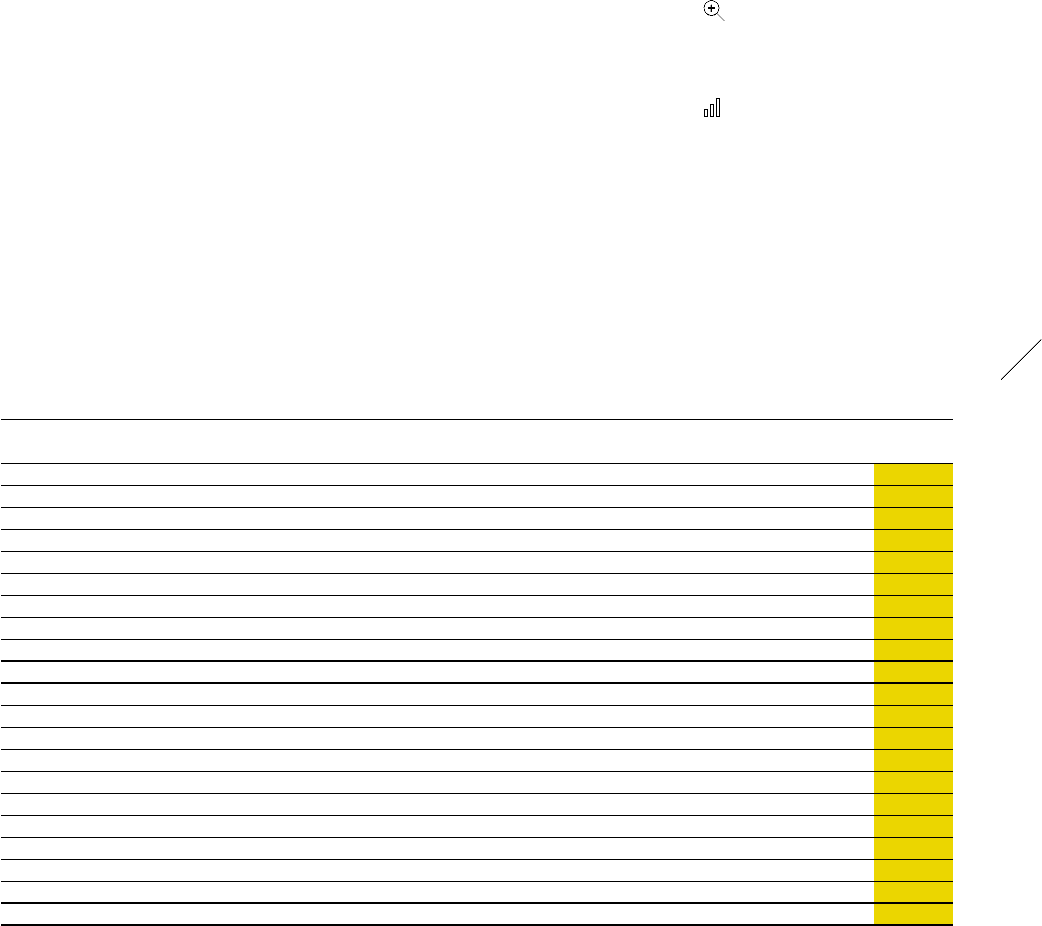

Future cash outflows arising from financial liabilities that are recognised in the Consolidated

Statement of Financial Position are presented in the table below. This includes payments to settle

obligations from borrowings as well as cash outflows from cash-settled derivatives with negative

market values. Financial liabilities that may be settled in advance without penalty are included on

the basis of the earliest date of potential repayment. Cash flows for variable-interest liabilities are

determined with reference to the conditions at the balance sheet date.

We ended the year 2014 with net debt of € 185 million (2013: net cash of € 295 million). Thus, the

ratio of net borrowings over EBITDA was 0.1 times at year-end, which is in line with the Group’s

medium-term guideline of less than two times.

see Treasury, p. 121

see Table 07

07

/

Future cash outflows 1) (€ in millions)

Up to

1 year

Up to

2 years

Up to

3 years

Up to

4 years

Up to

5 years

Up to

6 years

Up to

7 years

Total

As at December 31, 2014

Bank borrowings incl. commercial paper 2) 194 194

Private placements 3) 108 127 235

Eurobond 3) 17 17 17 17 17 17 617 719

Convertible bond 3) 1 1 502 504

Accounts payable 1,652 1,652

Other financial liabilities 38 7 44

Accrued liabilities 4) 491 491

Derivative financial liabilities 53 0 0 0 0 0 0 55

Total 2,554 152 519 17 17 17 617 3,894

As at December 31, 2013

Bank borrowings 2) 126 126

Private placements 3) 70 95 111 276

Eurobond 3) 514 514

Convertible bond 3) 1 1 1 502 505

Accounts payable 1,825 1,825

Other financial liabilities 33 9 42

Accrued liabilities 4) 464 464

Derivative financial liabilities 80 12 1 93

Total 3,113 117 113 502 3,845

1) Rounding difference may arise in totals.

2) Classified as long-term (between 1 and 3 years) in the consolidated financial statements, as they are covered by the committed mid-term syndicated loan.

3) Including interest payments.

4) Accrued interest excluded.