Reebok 2014 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

172

2014

/

03.5

/

adidas Group

/

2014 Annual Report

Group Management Report – Financial Review

Risk and Opportunity Report

/

Financial Risks

However, many other financial and operational variables that could potentially reduce the effect of

currency fluctuations are excluded from the analysis. For instance:

/

Interest rates, commodity prices and all other exchange rates are assumed constant.

/

Exchange rates are assumed at a year-end value instead of the more relevant sales-weighted

average figure, which we utilise internally to better reflect both the seasonality of our business

and intra-year currency fluctuations.

/

The underlying forecasted cash flow exposure (which the hedge instrument mainly relates to) is

not required to be revalued in this analysis.

/

Operational issues, such as potential discounts to key accounts, which have high transparency

regarding the impacts of currency on our sourcing activities (due to their own private label

sourcing efforts), are also excluded from this presentation.

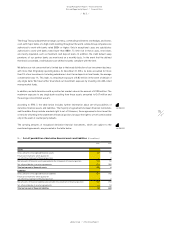

Utilising a centralised currency risk management system, our Group hedges currency needs for

projected sourcing requirements on a rolling basis up to 24 months in advance. Our goal is to have

the vast majority of our hedging volume secured six months prior to the start of a given season. In

rare instances, hedges are contracted beyond the 24-month horizon. The Group also largely hedges

balance sheet risks. Due to our strong global position, we are able to partly minimise currency risk

by utilising natural hedges.

Nevertheless, our gross US dollar cash flow exposure after natural hedges calculated for 2015 was

roughly € 5.2 billion at year-end 2014, which we hedged using forward exchange contracts, currency

options and currency swaps. Our Group’s Treasury Policy allows us to utilise hedging instruments,

such as currency options or option combinations, which provide protection from negative exchange

rate fluctuations while – at the same time – retaining the potential to benefit from future favourable

exchange rate developments in the financial markets.

As 2015 hedging has almost been completed, it is clear that the EUR/USD conversion rate will

improve compared to 2014. However, this positive effect is expected to be more than offset by

less favourable exchange rates in the emerging markets (in particular Russia). Volume forecast

variances, currency volatility and an increasing portion of our business in emerging markets, where

currencies have depreciated rapidly in 2014 and at the beginning of 2015, will expose the adidas

Group to substantial currency effects in 2015. Our financial targets set for 2015 take these trends

into consideration.

Risks related to impairment of goodwill/other intangible assets

As a result of various acquisitions in the past, our balance sheet carries book values of approximately

€ 1.2 billion in goodwill and € 1.6 billion in other intangible assets (including trademarks).

Deterioration in the business performance, and particularly in future business prospects, as well as

significant exchange rate fluctuations could require corrections of these book values by incurring

impairment charges. In addition, increases in market interest rates could trigger increases

in discount rates used in our impairment test for goodwill and require impairment charges. An

impairment charge would be a purely accounting, non-cash effect impacting the Group’s operating

result.

see Treasury, p. 121

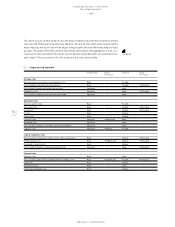

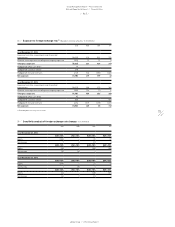

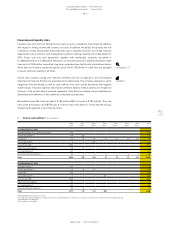

see Table 04

see Subsequent Events and Outlook, p. 146

see Note 02, p. 197