Reebok 2014 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

221

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

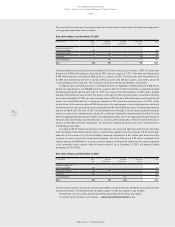

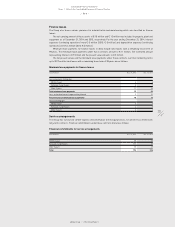

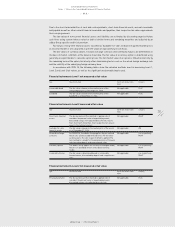

The expected payments for the 2015 financial year amount to € 12 million. Thereof, € 7 million relates to benefits

directly paid to pensioners by the Group companies and € 4 million to employer contributions paid into the plan

assets. In 2014, the actual return on plan assets was € 6 million (2013: € 6 million).

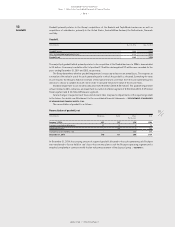

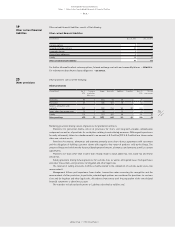

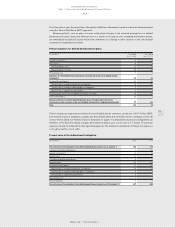

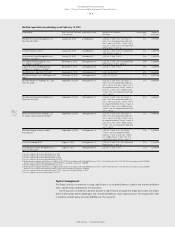

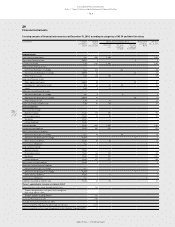

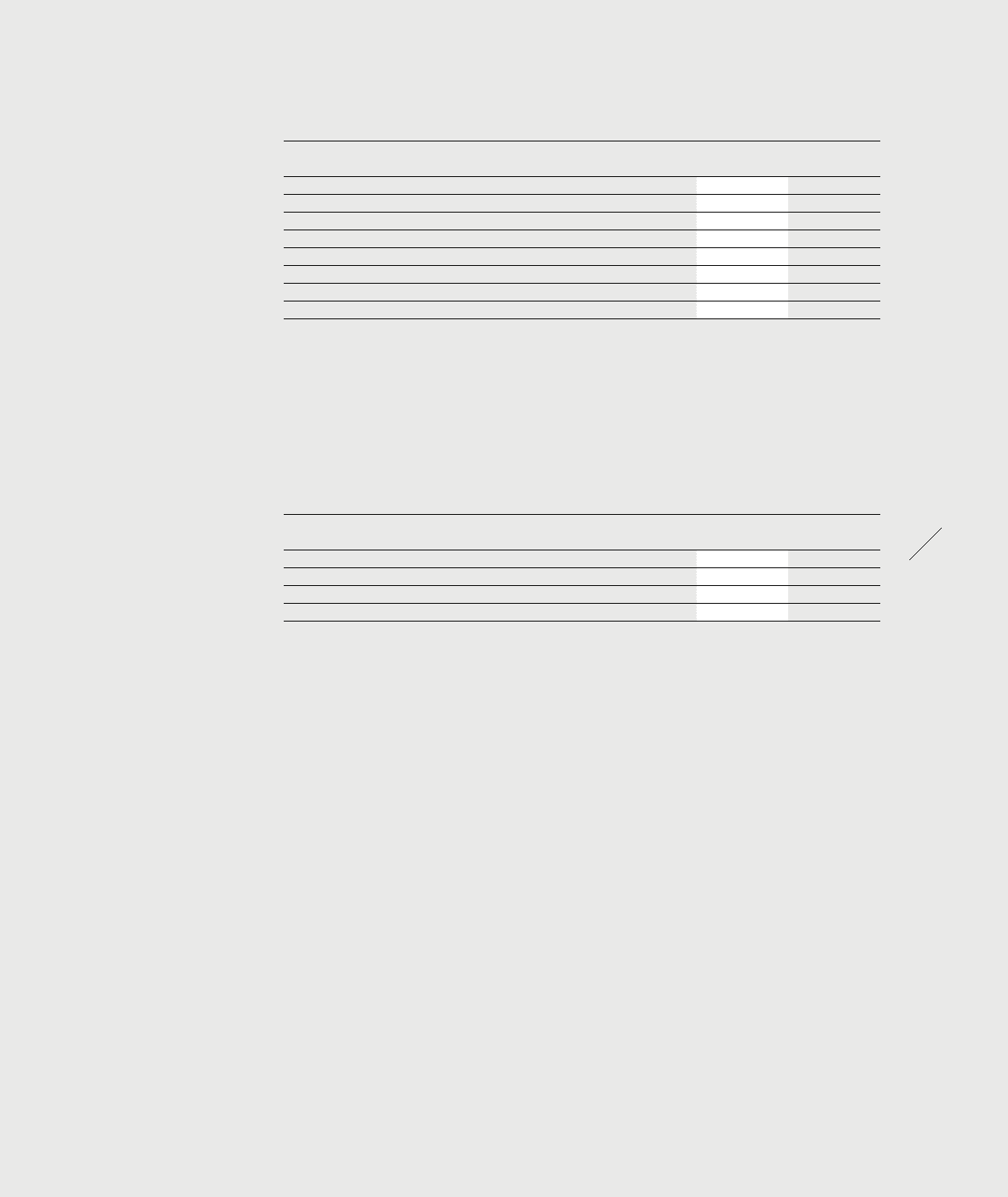

Composition of plan assets

(€ in millions) Dec. 31, 2014 Dec. 31, 2013

Cash and cash equivalents 31 14

Equity instruments 51 28

Bonds 41 11

Real estate 1 1

Pension plan reinsurance 27 25

Insurance policies 5 4

Other assets 0 0

Fair value of plan assets 157 83

All equities and bonds are traded freely and have a quoted market price in an active market. The other assets

consist predominantly of foreign insurance products.

At each balance sheet date, the company analyses the over- or underfunding and, where appropriate, adjusts

the composition of plan assets.

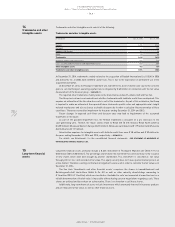

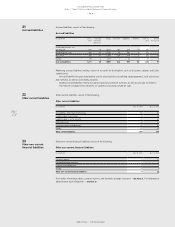

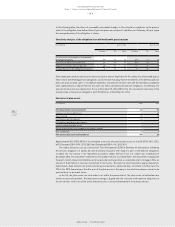

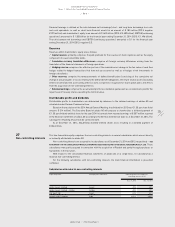

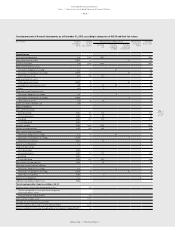

Other non-current liabilities consist of the following:

Other non-current liabilities

(€ in millions) Dec. 31, 2014 Dec. 31, 2013

Liabilities due to personnel 5 7

Deferred income 29 22

Sundry 1 0

Other non-current liabilities 35 29

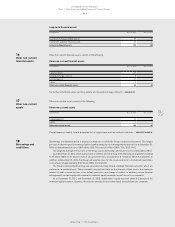

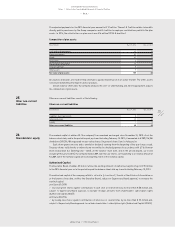

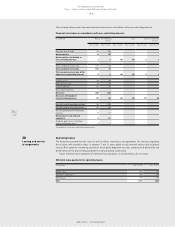

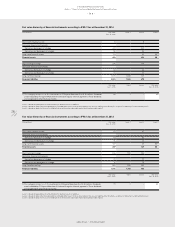

The nominal capital of adidas AG (‘the company’) has remained unchanged since December 31, 2013. As at the

balance sheet date, and in the period beyond, up to and including February 13, 2015, it amounted to € 209,216,186

divided into 209,216,186 registered no-par-value shares (‘registered shares’) and is fully paid in.

Each share grants one vote and is entitled to dividends starting from the beginning of the year it was issued.

Treasury shares held directly or indirectly are not entitled to dividend payment in accordance with § 71b German

Stock Corporation Act (Aktiengesetz – AktG). At the balance sheet date, and in the period beyond, up to and

including February 13, 2015, the company holds 4,889,142 treasury shares, corresponding to a notional amount of

€ 4,889,142 in the nominal capital and consequently 2.34% of the nominal capital.

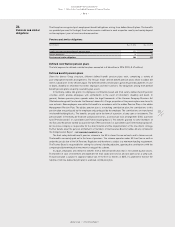

Authorised Capital

The Executive Board of adidas AG did not utilise the existing amounts of authorised capital of up to € 95 million

in the 2014 financial year or in the period beyond the balance sheet date up to and including February 13, 2015.

The authorised capital of the company, which is set out in § 4 sections 2, 3 and 4 of the Articles of Association as

at the balance sheet date, entitles the Executive Board, subject to Supervisory Board approval, to increase the

nominal capital

until June 30, 2018

/

by issuing new shares against contributions in cash once or several times by no more than € 50 million and,

subject to Supervisory Board approval, to exclude residual amounts from shareholders’ subscription rights

(Authorised Capital 2013/I);

until June 30, 2016

/

by issuing new shares against contributions in kind once or several times by no more than € 25 million and,

subject to Supervisory Board approval, to exclude shareholders’ subscription rights (Authorised Capital 2013/II);

25

Other non-current

liabilities

26

Shareholders’ equity