Reebok 2014 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

199

2014

Notes

/

04.8

/

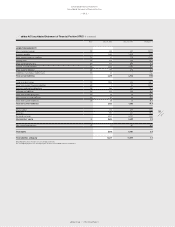

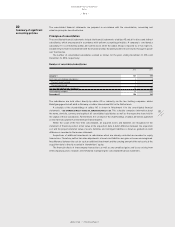

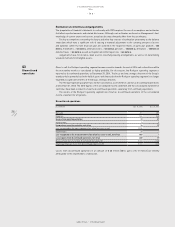

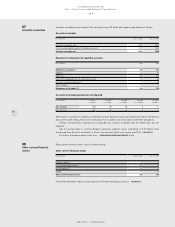

A summary of exchange rates to the euro for major currencies in which the Group operates is as follows:

Exchange rates

(€ 1 equals) Average rates for the year ending Dec. 31, Spot rates at Dec. 31,

2014 2013 2014 2013

USD 1.3296 1.3283 1.2141 1.3791

GBP 0.8066 0.8492 0.7789 0.8337

JPY 140.4395 129.5777 145.2300 144.7200

CNY 8.1919 8.1674 7.4291 8.4082

RUB 50.7372 42.2979 68.3033 45.1368

Discontinued operations

A component of the Group’s business is classified as a discontinued operation if the operations and cash flows of

the component can be clearly distinguished, operationally and for financial reporting purposes, from the rest of

the Group and if the component either has been disposed of or is classified as held for sale, and:

/

represents a separate major line of business or geographic area of operations,

/

is part of a single coordinated plan to dispose of a separate major line of business or geographic area of

operations or

/

is a subsidiary acquired exclusively with a view to resale.

When an operation is classified as a discontinued operation, the comparative consolidated income statement and

consolidated statement of cash flows are restated and presented as if the operation had been discontinued from

the start of the comparative year.

Derivative financial instruments

The Group uses derivative financial instruments, such as currency options, forward exchange contracts,

commodity futures as well as interest rate swaps and cross-currency interest rate swaps, to hedge its exposure

to foreign exchange, commodity price and interest rate risks. In accordance with its Treasury Policy, the Group

does not enter into transactions with derivative financial instruments for trading purposes.

Derivative financial instruments are initially recognised in the statement of financial position at fair value,

and subsequently also measured at their fair value. The method of recognising the resulting gains or losses is

dependent on the nature of the hedge. On the date a derivative contract is entered into, the Group designates

derivatives as either a hedge of a forecasted transaction (cash flow hedge), a hedge of the fair value of a recognised

asset or liability (fair value hedge) or a hedge of a net investment in a foreign entity.

Changes in the fair value of derivatives that are designated and qualify as cash flow hedges, and that are

effective, as defined in IAS 39 ‘Financial instruments: recognition and measurement’, are recognised in equity.

When the effectiveness is not 100%, the ineffective portion of the change in the fair value is recognised in the

income statement. Accumulated gains and losses in equity are transferred to the income statement in the same

periods during which the hedged forecasted transaction affects the income statement.

For derivative financial instruments designated as fair value hedges, the gains or losses on the derivatives and

the offsetting gains or losses on the hedged items are recognised immediately in the income statement.

Certain derivative transactions, while providing effective economic hedges under the Group’s risk management

policies, may not qualify for hedge accounting under the specific rules of IAS 39. Changes in the fair value of any

derivative instruments that do not meet these rules are recognised immediately in the income statement.

Hedges of net investments in foreign entities are accounted for in a similar way to cash flow hedges. If, for

example, the hedging instrument is a derivative (e.g. a forward exchange contract) or, for example, a foreign

currency borrowing, effective currency gains and losses in the derivative and all gains and losses arising on the

translation of the borrowing, respectively, are recognised in equity.