Reebok 2014 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

224

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

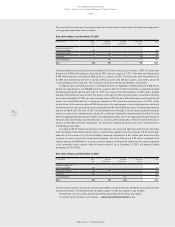

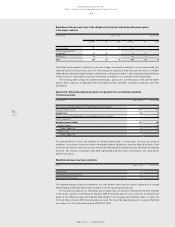

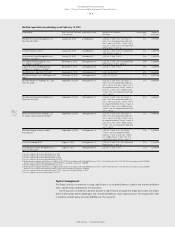

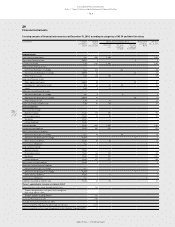

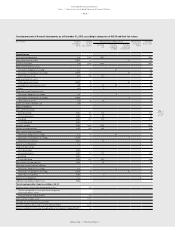

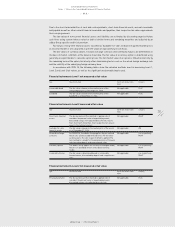

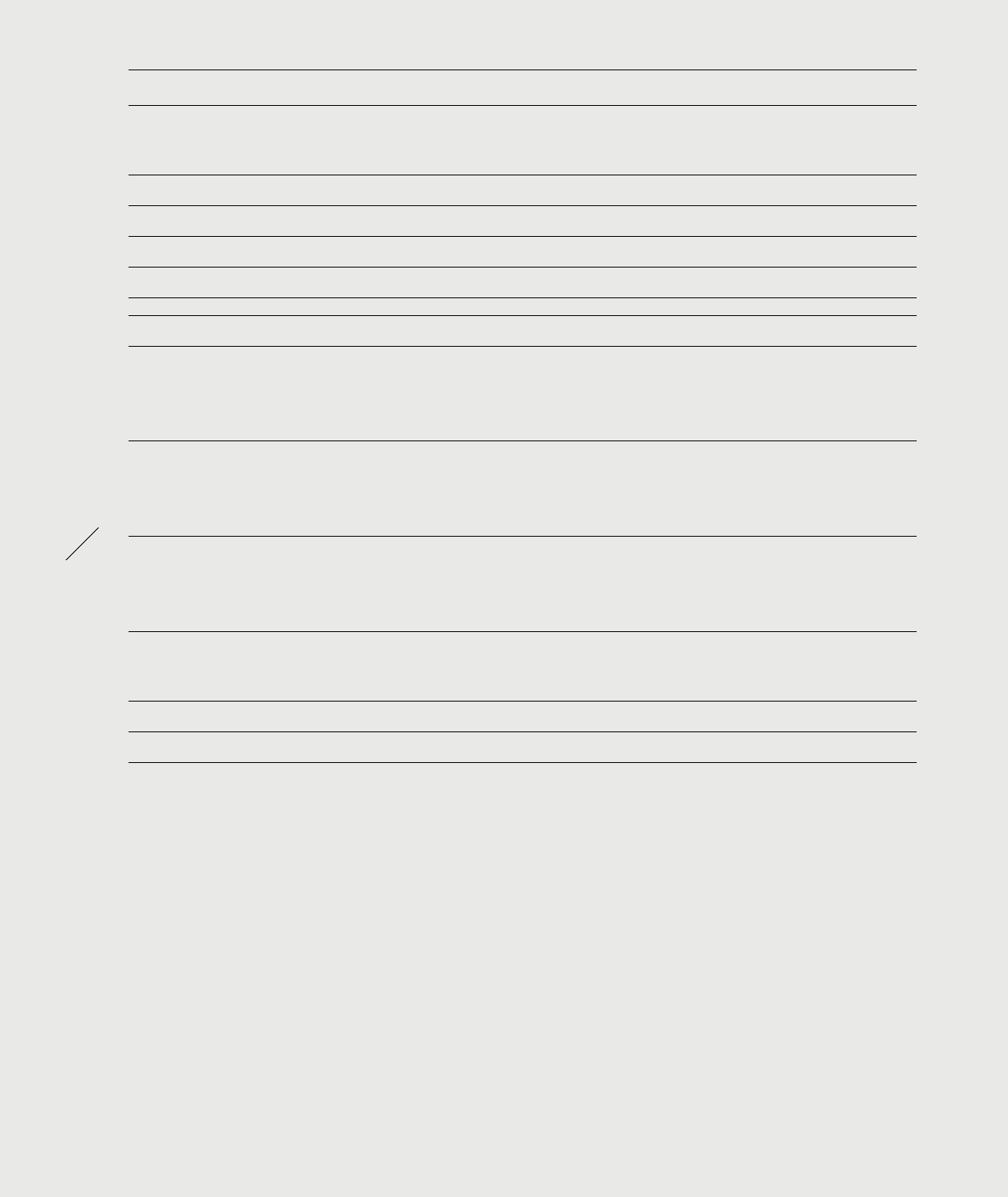

Notifying party Date of reaching, exceeding

or falling below

Reporting threshold Attributions in accordance

with WpHG

Shareholdings

in %

Number of

voting rights

BlackRock Financial Management, Inc.,

New York, NY, USA 1)

January 28, 2015 Exceeding 3% § 22 sec. 1 sent. 1 no. 1, § 22 sec. 1

sent. 1 no. 2 in conjunction with § 22

sec. 1 sent. 2, § 22 sec. 1 sent. 1 no. 6,

§ 22 sec. 1 sent. 1 no. 6 in conjunction

with § 22 sec. 1 sent. 2

3.21 6,709,315

O. Mason Hawkins, USA 2) January 22, 2015 Exceeding 3% § 22 sec. 1 sent. 1 no. 6 in conjunction

with § 22 sec. 1 sent. 2

3.06 6,398,123

Southeastern Asset Management, Inc.,

Memphis, TN, USA 2)

January 22, 2015 Exceeding 3% § 22 sec. 1 sent. 1 no. 6 3.06 6,398,123

The Capital Group Companies, Inc.,

Los Angeles, CA, USA 3)

December 2, 2014 Falling below 3% § 22 sec. 1 sent. 1 no. 6 in conjunction

with § 22 sec. 1 sent. 2 and 3

2.88 6,018,378

Capital Research and Management

Company, Los Angeles, CA, USA 3)

December 2, 2014 Falling below 3% § 22 sec. 1 sent. 1 no. 6 2.88 6,018,378

BlackRock, Inc., New York, NY, USA 4) November 20, 2014 Falling below 5% §§ 21, 22, 25, 25a 5) 4.99 10,432,583

BlackRock Holdco 2, Inc., Wilmington, DE,

USA 6)

November 13, 2014 Falling below 5% §§ 21, 22, 25, 25a 7) 4.99 10,431,246

BlackRock Advisors Holdings, Inc., New

York, NY, USA 8)

September 25, 2014 Falling below 3% § 22 sec. 1 sent. 1 no. 1, § 22 sec. 1

sent. 1 no. 2 in conjunction with § 22

sec. 1 sent. 2, § 22 sec. 1 sent. 1 no. 6

in conjunction with § 22 sec. 1 sent. 2,

§ 22 sec. 1 sent. 1 no. 1 and § 22 sec.

1 sent. 1 no. 6 in conjunction with § 22

sec. 1 sent. 2

2.61 5,465,659

BlackRock International Holdings, Inc.,

New York, NY, USA 8)

September 25, 2014 Falling below 3% § 22 sec. 1 sent. 1 no. 1, § 22 sec. 1

sent. 1 no. 2 in conjunction with § 22

sec. 1 sent. 2, § 22 sec. 1 sent. 1 no. 6

in conjunction with § 22 sec. 1 sent. 2,

§ 22 sec. 1 sent. 1 no. 1 and § 22 sec.

1 sent. 1 no. 6 in conjunction with § 22

sec. 1 sent. 2

2.61 5,465,659

BR Jersey International Holdings, L.P.,

St. Helier, Jersey, Channel Islands 8)

September 25, 2014 Falling below 3% § 22 sec. 1 sent. 1 no. 1, § 22 sec. 1

sent. 1 no. 2 in conjunction with § 22

sec. 1 sent. 2, § 22 sec. 1 sent. 1 no. 6

in conjunction with § 22 sec. 1 sent. 2,

§ 22 sec. 1 sent. 1 no. 1 and § 22 sec.

1 sent. 1 no. 6 in conjunction with § 22

sec. 1 sent. 2

2.61 5,465,659

BlackRock Group Limited, London,

Great Britain 8)

September 25, 2014 Falling below 3% § 22 sec. 1 sent. 1 no. 1, § 22 sec.

1 sent. 1 no. 6 in conjunction with

§ 22 sec. 1 sent. 2, § 22 sec. 1 sent. 1

no. 1 and § 22 sec. 1 sent. 1 no. 6 in

conjunction with § 22 sec. 1 sent. 2

2.46 5,138,626

Garrett Thornburg, USA 9) August 4, 2014 Falling below 3% § 22 sec. 1 sent. 1 no. 6 in conjunction

with § 22 sec. 1 sent. 2

2.73 5,714,818

Thornburg Investment Management, Inc.,

Santa Fe, NM, USA 9)

August 4, 2014 Falling below 3% § 22 sec. 1 sent. 1 no. 6 2.73 5,714,818

1) See the company’s disclosure dated February 3, 2015.

2) See the company’s disclosure dated January 26, 2015.

3) See the company’s disclosure dated December 8, 2014.

4) See the company’s disclosure dated November 26, 2014.

5) Notification in accordance with § 25a sec. 1 WpHG: 0.01% (19,904) in accordance with § 25a WpHG (thereof 0.01% = 19,904 held indirectly); 0.22% (457,602) in accordance with § 25 WpHG

(thereof 0.22% = 457,602 held indirectly); 4.76% (9,955,077) in accordance with §§ 21, 22 WpHG.

6) See the company’s disclosure dated November 20, 2014.

7) Notification in accordance with § 25a sec. 1 WpHG: 0.01% (22,561) in accordance with § 25a WpHG (thereof 0.01% = 22,561 held indirectly); 0.17% (356,251) in accordance with § 25 WpHG

(thereof 0.17% = 356,251 held indirectly); 4.80% (10,052,434) in accordance with §§ 21, 22 WpHG.

8) See the company’s disclosure dated September 30, 2014 and correction dated October 6, 2014.

9) See the company’s disclosure dated August 14, 2014.

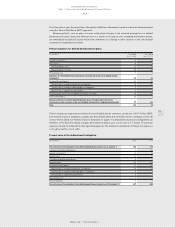

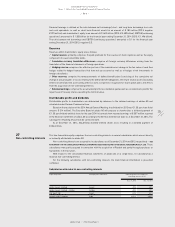

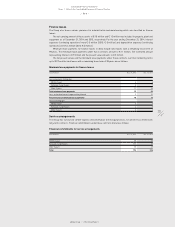

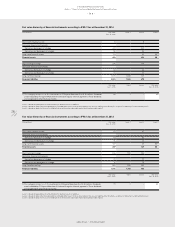

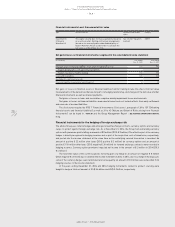

Capital management

The Group’s policy is to maintain a strong capital base so as to uphold investor, creditor and market confidence

and to sustain future development of the business.

The Group seeks to maintain a balance between a higher return on equity that might be possible with higher

levels of borrowings and the advantages and security afforded by a sound capital position. The Group further aims

to maintain net debt below two times EBITDA over the long term.

Notified reportable shareholdings as at February 13, 2015