Reebok 2014 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

231

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

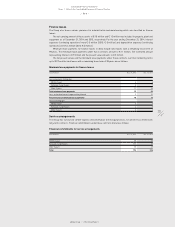

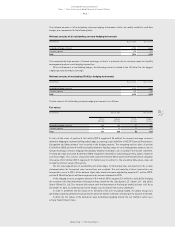

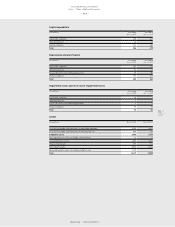

Due to the short-term maturities of cash and cash equivalents, short-term financial assets, accounts receivable

and payable as well as other current financial receivables and payables, their respective fair values approximate

their carrying amount.

The fair values of non-current financial assets and liabilities are estimated by discounting expected future

cash flows using current interest rates for debt of similar terms and remaining maturities and adjusted by an

adidas Group specific credit risk premium.

Fair values of long-term financial assets classified as ‘Available-for-sale’ are based on quoted market prices

in an active market or are calculated as present values of expected future cash flows.

The fair values of currency options, forward exchange contracts and commodity futures are determined on

the basis of market conditions at the balance sheet date. The fair value of a currency option is determined using

generally accepted models to calculate option prices. The fair market value of an option is influenced not only by

the remaining term of the option, but also by other determining factors such as the actual foreign exchange rate

and the volatility of the underlying foreign currency base.

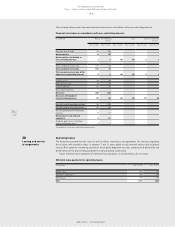

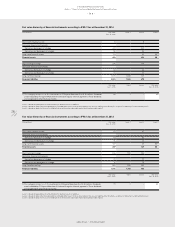

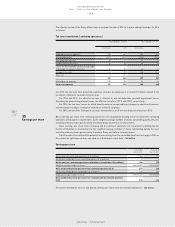

In accordance with IFRS 13, the following tables show the valuation methods used in measuring Level 1,

Level 2 and Level 3 fair values, as well as the significant unobservable inputs used.

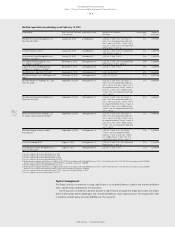

Financial instruments Level 1 not measured at fair value

Type Valuation method Significant unobservable

inputs

Category

Convertible bond The fair value is based on the market price of the

convertible bond as at December 31, 2014.

Not applicable FLAC

Eurobond The fair value is based on the market price of the

Eurobond as at December 31, 2014.

Not applicable FLAC

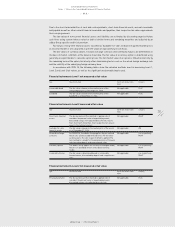

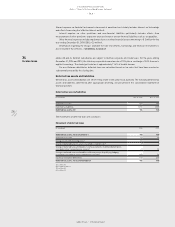

Financial instruments Level 2 measured at fair value

Type Valuation method Significant unobservable

inputs

Category

Short-term financial

assets

The discounted cash flow method is applied, which

considers the present value of expected payments,

discounted using a risk-adjusted discount rate. Due to

their short-term maturities, their respective fair value is

equal to the notional amount.

Not applicable FAHfT

Available-for-sale

financial assets

The fair value is based on the market price of the assets

as at December 31, 2014.

Not applicable AfS

Forward exchange

contracts

For EUR/USD, the adidas Group applies the par method,

which uses actively traded forward rates. For the other

currency pairs, the zero coupon method is applied. The

zero method is a model for the determination of forward

rates based on deposit and swap interest rates.

Not applicable n.a. respectively

FAHfT

Currency options The adidas Group applies the Garman-Kohlhagen model,

which is an extended version of the Black-Scholes

model.

Not applicable n.a. respectively

FAHfT

Commodity futures The fair value is determined based on commodity

forward curves, discounted by deposit and swap interest

rates.

Not applicable n.a. respectively

FAHfT

Financial instruments Level 2 not measured at fair value

Type Valuation method Significant unobservable

inputs

Category

Private placements The discounted cash flow method is applied, which

considers the present value of expected payments,

discounted using a risk-adjusted discount rate.

Not applicable FLAC