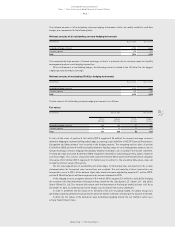

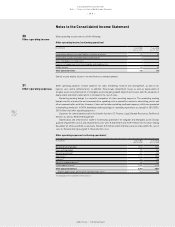

Reebok 2014 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

233

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

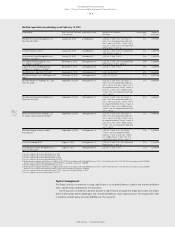

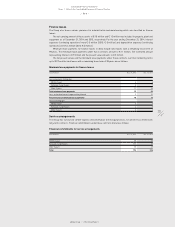

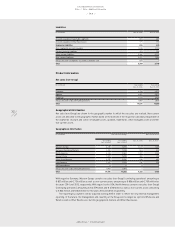

The notional amounts of all outstanding currency hedging instruments, which are mainly related to cash flow

hedges, are summarised in the following table:

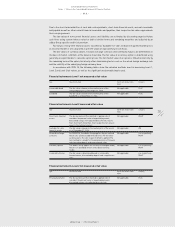

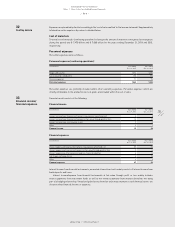

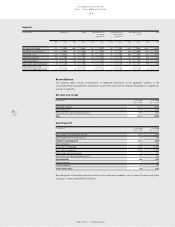

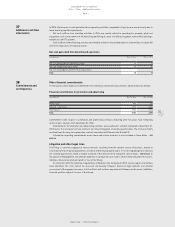

Notional amounts of all outstanding currency hedging instruments

(€ in millions) Dec. 31, 2014 Dec. 31, 2013

Forward exchange contracts 6,738 4,430

Currency options 278 472

Total 7,016 4,902

The comparatively high amount of forward exchange contracts is primarily due to currency swaps for liquidity

management purposes and hedging transactions.

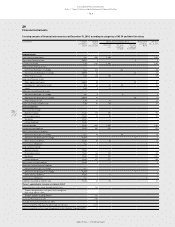

Of the total amount of outstanding hedges, the following contracts related to the US dollar (i.e. the biggest

single exposure of product sourcing):

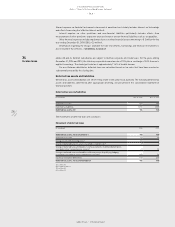

Notional amounts of outstanding US dollar hedging instruments

(€ in millions) Dec. 31, 2014 Dec. 31, 2013

Forward exchange contracts 3,192 2,605

Currency options 278 425

Total 3,470 3,030

The fair value of all outstanding currency hedging instruments is as follows:

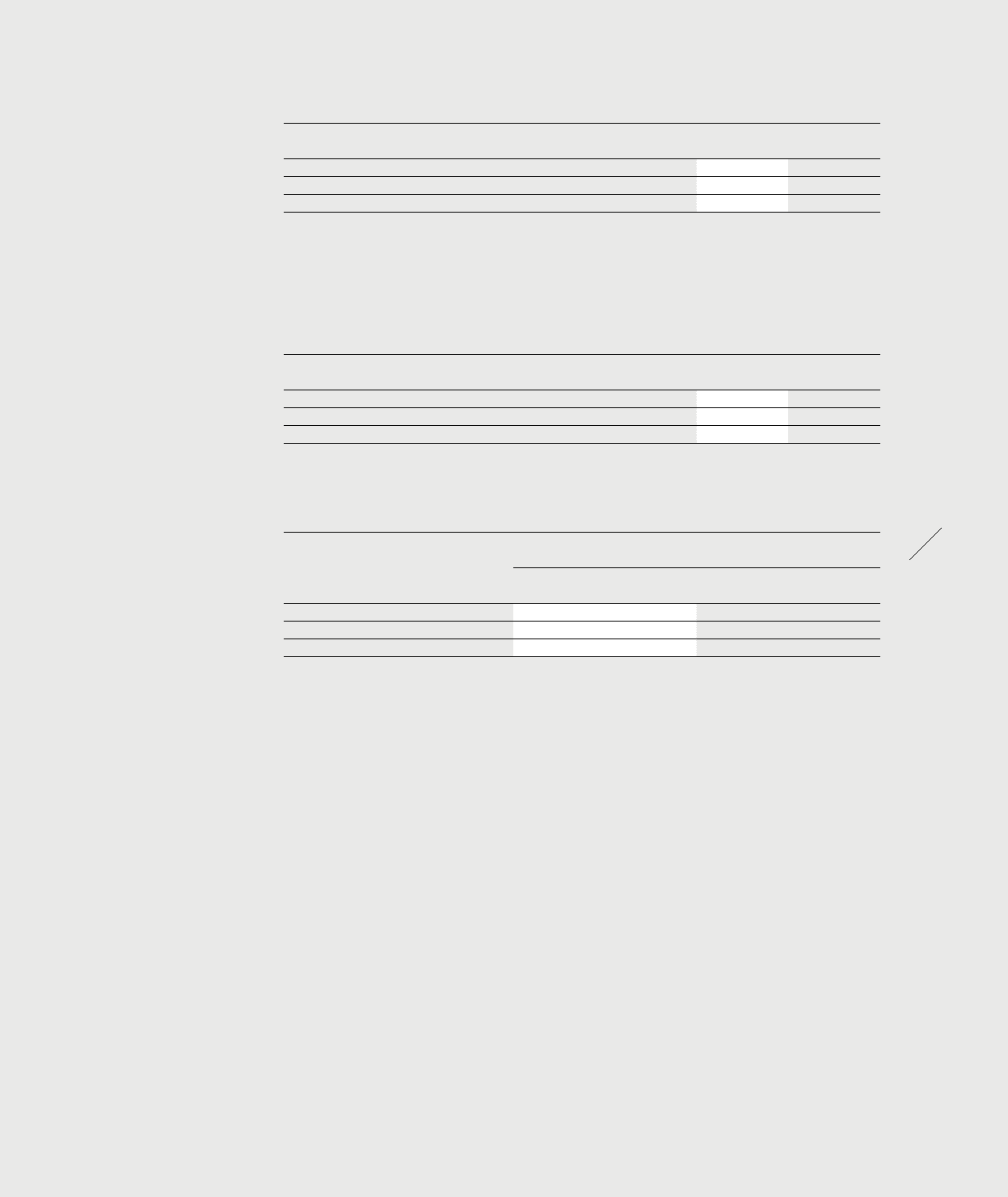

Fair values

(€ in millions) Dec. 31, 2014 Dec. 31, 2013

Positive

fair value

Negative

fair value

Positive

fair value

Negative

fair value

Forward exchange contracts 245 (50) 47 (79)

Currency options 26 (0) 11 (13)

Total 271 (50) 58 (92)

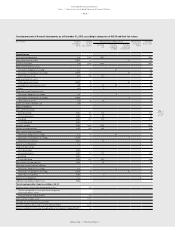

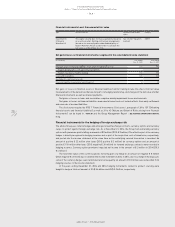

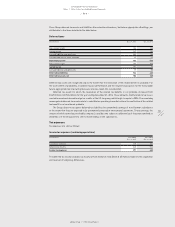

A total net fair value of positive € 163 million (2013: negative € 36 million) for forward exchange contracts

related to hedging instruments falling under hedge accounting as per definition of IAS 39 ‘Financial Instruments:

Recognition and Measurement’ was recorded in the hedging reserve. The remaining net fair value of positive

€ 32 million (2013: positive € 4 million), mainly related to liquidity swaps for cash management purposes and to

forward exchange contracts hedging intercompany dividend receivables, was recorded in the income statement.

The total fair value of positive € 26 million (2013: negative € 2 million) for outstanding currency options related to

cash flow hedges. This consists of a positive time value of € 0 million (2013: positive € 8 million) and of a negative

time value of € 0 million (2013: negative € 12 million) and, in contrast to the preceding table above, does not

include the intrinsic value of the options.

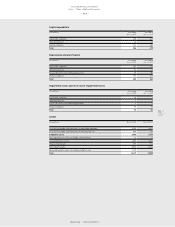

The fair value adjustments of outstanding cash flow hedges for forecasted sales are reported in the income

statement when the forecasted sales transactions are recorded. The vast majority of these transactions are

forecasted to occur in 2015. At the balance sheet date, inventories were adjusted by negative € 1 million (2013:

positive € 20 million) which will be recognised in the income statement in 2015.

In the hedging reserve, a negative amount of € 4 million (2013: negative € 6 million) is included for hedging

the currency risk of net investments in foreign entities, mainly for the subsidiaries LLC “adidas, Ltd.” and adidas

Sports (China) Co. Ltd. This reserve will remain until the investment in the foreign entity has been sold. As at

December 31, 2014, no ineffective part of the hedges was recorded in the income statement.

In order to determine the fair values of its derivatives that are not publicly traded, the adidas Group uses

generally accepted quantitative financial models based on market conditions prevailing at the balance sheet date.

In 2014, the fair values of the derivatives were determined applying mainly the ‘par method’, which uses

actively traded forward rates.