Reebok 2014 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2014 Annual Report

Consolidated Financial Statements

225

2014

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

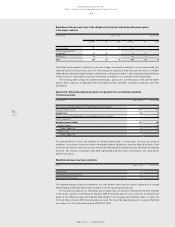

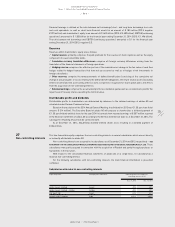

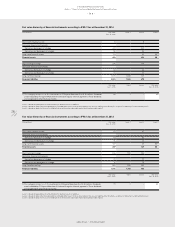

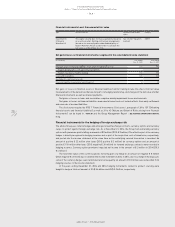

Financial leverage is defined as the ratio between net borrowings (short- and long-term borrowings less cash

and cash equivalents as well as short-term financial assets) in an amount of € 185 million (2013: negative

€ 295 million) and shareholders’ equity in an amount of € 5.624 billion (2013: € 5.489 billion). EBITDA (continuing

operations) amounted to € 1.283 billion for the financial year ending December 31, 2014 (2013: € 1.496 billion).

The ratio between net borrowings and EBITDA (continuing operations) amounted to 0.1 for the financial year

ending December 31, 2014 (2013: negative 0.2).

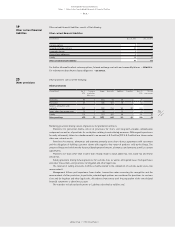

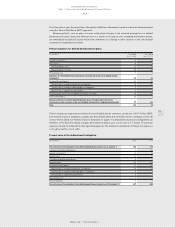

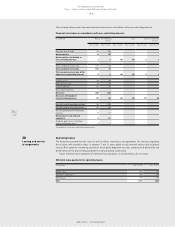

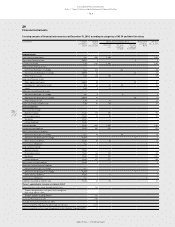

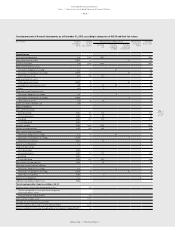

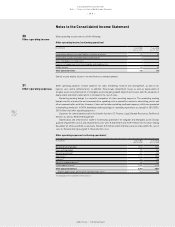

Reserves

Reserves within shareholders’ equity are as follows:

/

Capital reserve: primarily comprises the paid premium for the issuance of share capital as well as the equity

component of issued convertible bonds.

/

Cumulative currency translation differences: comprise all foreign currency differences arising from the

translation of the financial statements of foreign operations.

/

Hedging reserve: comprises the effective portion of the cumulative net change in the fair value of cash flow

hedges related to hedged transactions that have not yet occurred as well as of hedges of net investments in

foreign subsidiaries.

/

Other reserves: comprise the remeasurements of defined benefit plans [consisting of the cumulative net

change of actuarial gains or losses relating to the defined benefit obligations, the return on plan assets (excluding

interest income) and the asset ceiling effect] as well as expenses recognised for share option plans and effects

from the acquisition of non-controlling interests.

/

Retained earnings: comprise the accumulated profits less dividends paid as well as considerations paid for the

repurchase of treasury shares exceeding the nominal value.

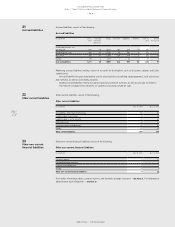

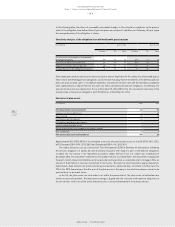

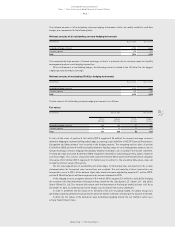

Distributable profits and dividends

Distributable profits to shareholders are determined by reference to the retained earnings of adidas AG and

calculated under German Commercial Law.

Based on the resolution of the 2014 Annual General Meeting, the dividend for 2013 was € 1.50 per share (total

amount: € 314 million). The Executive Board of adidas AG will propose to shareholders a dividend payment of

€ 1.50 per dividend-entitled share for the year 2014 to be made from retained earnings of € 307 million reported

in the financial statements of adidas AG according to the German Commercial Code as at December 31, 2014. The

subsequent remaining amount will be carried forward.

As at December 31, 2014, 204,327,044 dividend-entitled shares exist, resulting in a dividend payment of

€ 306 million.

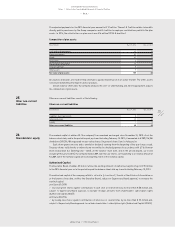

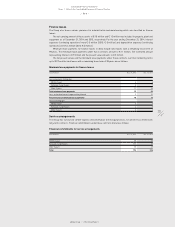

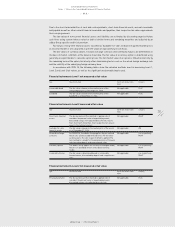

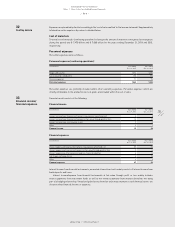

This line item within equity comprises the non-controlling interests in several subsidiaries which are not directly

or indirectly attributable to adidas AG.

Non-controlling interests are assigned to six subsidiaries as at December 31, 2014 and 2013, respectively

/

SEE

ATTACHMENT II TO THE CONSOLIDATED FINANCIAL STATEMENTS (SEE SHAREHOLDINGS OF ADIDAS AG, HERZOGENAURACH, P. 248). These

subsidiaries were partly acquired in connection with the acquisition of Reebok and partly through purchases or

foundations in the last years.

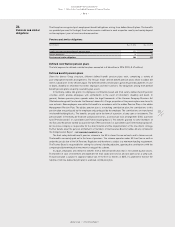

With respect to the consolidated financial statements of adidas AG, on a single basis, no subsidiary has a

material non-controlling interest.

For the following subsidiaries with non-controlling interests the main financial information is presented

combined.

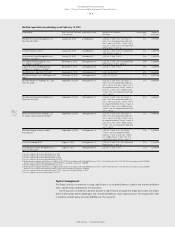

Subsidiaries with material non-controlling interests

Legal entity name Principle place of business Ownership interests held by non-

controlling interests (in %)

Dec. 31, 2014 Dec. 31, 2013

adidas Levant Limited Levant 45% 45%

adidas Levant Limited – Jordan Jordan 45% 45%

Life Sport Ltd. Israel 49% 49%

Reebok India Company India 6.85% 6.85%

27

Non-controlling interests