Reebok 2014 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report – Financial Review

183

2014

Management Assessment of Performance, Risks and Opportunities, and Outlook

/

03.6

/

adidas Group

/

2014 Annual Report

the Group as a going concern. This assessment is also supported by the historical response to our

financing demands. The adidas Group therefore has not sought an official rating by any of the leading

rating agencies. We remain confident that the Group’s earnings strength forms a solid basis for our

future business development and provides the resources necessary to pursue the opportunities

available to the Group. Compared to the prior year, our assessment of certain risks has changed

in terms of likelihood of occurrence and/or potential financial impact. The partial changes in risk

evaluation have no substantial impact on the overall adidas Group risk profile, which we believe

remains virtually unchanged compared to the prior year.

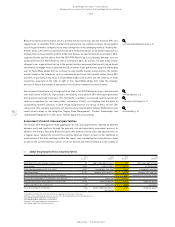

Assessment of financial outlook

In November 2010, the Group unveiled its 2015 strategic business plan named ‘Route 2015’, which

defined strategies and objectives for the period up to 2015. In 2014, mainly due to the continued

weakness in the golf market, negative economic developments in Russia/CIS as well as ongoing

currency headwinds, the Group postponed the delivery of its top- and bottom-line Route 2015

targets. As a result, we have been undergoing a strategic review of priorities and our organisational

set-up throughout 2014 and early 2015. We will release details on our updated strategies at the end

of March 2015.

In 2015, we will see a specific emphasis on continuing to pursue growth opportunities, while also

focusing on driving improvements in the Group’s earnings. We will increase our investments in

brand-building activities and continue to focus on innovation platforms such as Boost, expanding

our digital activities as well as rolling out our new own-retail concepts globally.

Through our extensive pipeline of new and innovative products, which have received favourable

reviews from retailers, as well as through tight control of inventory levels and strict cost

management, we project top- and bottom-line improvements in our Group’s financial results

in 2015. The Group’s profitability is expected to benefit primarily from higher product margins

at TaylorMade-adidas Golf as well as a more favourable pricing and product mix at adidas and

Reebok. We believe that our outlook for 2015 is realistic within the scope of the current trading

and economic environment.

Assuming no significant deterioration in the global economy, we are confident to grow our top and

bottom line in 2015. However, the high degree of uncertainty regarding the economic outlook and

consumer sentiment in certain geographical areas, in particular Russia/CIS, as well as persisting

high levels of currency volatility, represent risks to the achievement of our stated financial goals

and aspirations. No other material event between the end of 2014 and the publication of this report

has altered our view.

see Treasury, p. 121

see Risk and Opportunity Report, p. 154

see Group Strategy, p. 46

see Global Brands Strategy, p. 53

see Global Sales Strategy, p. 49

see Subsequent Events and Outlook, p. 146

see Group Strategy, p. 46