Reebok 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

2014

/

03.2

/

adidas Group

/

2014 Annual Report

Group Management Report – Financial Review

Group Business Performance

/

Treasury

Centralised treasury function

In accordance with our Group’s Treasury Policy, all worldwide credit lines are directly or indirectly

managed by the Group Treasury department. Portions of those lines are allocated to the Group’s

subsidiaries and backed by adidas AG guarantees. As a result of this centralised liquidity management,

the Group is well positioned to allocate resources efficiently throughout the organisation. The Group’s

debt is generally unsecured and may include standard financial covenants, which are reviewed on a

quarterly basis. We maintain good relations with numerous partner banks, thereby avoiding a high

dependency on any single financial institution. Banking partners of the Group and our subsidiaries

are required to have at least a BBB+ long-term investment grade rating by Standard & Poor’s or an

equivalent rating by another leading rating agency. Only in exceptional cases are Group companies

authorised to work with banks with a lower rating. To ensure optimal allocation of the Group’s liquid

financial resources, subsidiaries transfer excess cash to the Group’s headquarters in all instances

where it is legally and economically feasible. In this regard, the standardisation and consolidation of

the Group’s global cash management and payment processes, including automated domestic and

cross-border cash pools, is a key priority for Group Treasury. In 2014, we successfully implemented

a new in-house bank module in order to further automate intra-Group settlements.

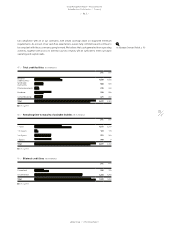

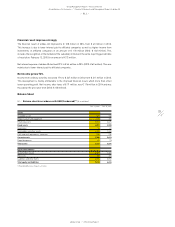

Group financial flexibility

The adidas Group’s financial flexibility is ensured by the availability of unutilised credit facilities

of € 1.846 billion at the end of 2014 (2013: € 2.026 billion). These include a committed syndicated

loan facility of € 500 million as well as bilateral credit lines at different banks of € 1.346 billion

(2013: € 1.526 billion). The syndicated loan facility has a remaining time to maturity of five years.

We monitor the ongoing need for available credit lines based on the current level of debt as well as

future financing requirements.

Successful issuance of two Eurobonds

2014 saw the successful issuance of two Eurobonds with an overall volume of € 1 billion. The

seven-year Eurobond of € 600 million matures on October 8, 2021 and has a coupon of 1.25%. The

twelve-year Eurobond of € 400 million matures on October 8, 2026 and has a coupon of 2.25%. With

this transaction, we have taken the opportunity of a low interest rate environment in the Eurobond

market to further strengthen the Group’s financing mix while increasing the overall duration.

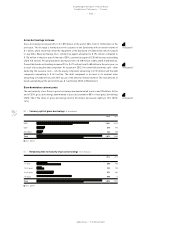

Bilateral credit lines decrease

At the end of 2014, bilateral credit lines declined 8% to € 1.520 billion compared to € 1.652 billion

in the prior year, as a result of the issuance of two Eurobonds. Committed and uncommitted credit

lines represent approximately 15% and 85% of total short-term bilateral credit lines, respectively

(2013: 22% and 78%).

Standard financial covenants

In the case of our committed credit facilities, we have entered into various covenants. These

covenants may include limits on the disposal of fixed assets, the amount of debt secured by

liens, cross default provisions and change of control. In addition, certain financial arrangements

contain equity ratio covenants, minimum equity covenants as well as net loss covenants. If we

failed to meet any covenant and were unable to obtain a waiver from a majority of partner banks,

borrowings would become due and payable immediately. As at December 31, 2014, we were in

see Risk and Opportunity Report, p. 154

see Glossary, p. 258

see Note 18, p. 213

see Diagram 49