Reebok 2014 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

178

2014

/

03.5

/

adidas Group

/

2014 Annual Report

Group Management Report – Financial Review

Risk and Opportunity Report

/

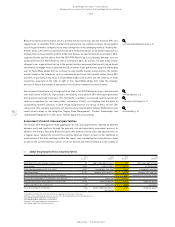

Strategic and Operational Opportunities

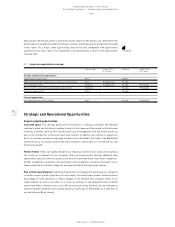

Opportunities which have a mid- to long-term positive impact for the Group’s top- and bottom-line

performance are already reflected in the Group’s strategic aspirations and are therefore not included

in this report. As a result, some opportunities may not be fully comparable with opportunities

presented in last year’s report. The assessment of all opportunities is shown in the opportunities

overview table.

Strategic and Operational Opportunities

Organic growth opportunities

Controlled space: The sporting goods retail environment is changing constantly. We therefore

continue to adapt our distribution strategy to cater for this change and have made controlled space

initiatives a strategic priority. This includes retail space management with key retail partners as

well as the introduction of new own-retail store formats. In addition, we continue to expand our

direct-to-consumer activities in emerging markets such as South East Asia, India or the Middle East

and North Africa. Successful results from these initiatives could enable us to accelerate top- and

bottom-line growth.

Fashion trends: Trends can rapidly change in our industry as certain styles, looks and colourways

fall in and out of relevance for the consumer. Given our broad product offering, additional sales

opportunities may arise when our products are more on-trend than those of our major competitors.

Further establishing a premium price positioning could strengthen consumers’ perception of our

brands, particularly in fashion categories, and open up additional margin opportunities.

New activities and categories: Exploiting the potential of emerging, fast-growing sports categories

is another organic growth opportunity for our brands. Our brand teams conduct market research

and engage in trend marketing to detect changes in the lifestyle and consumer needs of our

target audience as early as possible. As a result, we continue to see untapped market potential

around new fitness concepts such as CrossFit and obstacle racing. Similarly, we see tremendous

additional growth potential in the running category, in particular in North America, on the back of

our revolutionary Boost concept.

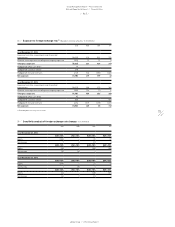

see Table 08

08

/

Corporate opportunities overview

Potential impact Change in 2014

(2013 rating)

Likelihood Change in 2014

(2013 rating)

Strategic and operational opportunities

Organic growth opportunities Major Unlikely

Opportunities related to organisational and process improvements Major (Significant) Possible

Personnel opportunities Moderate (Significant) Possible (Unlikely)

Macroeconomic, socio-political and regulatory opportunities Moderate Possible (Unlikely)

Acquisition opportunities Minor Possible

Financial opportunities

Favourable financial market changes Major Possible (Unlikely)