Reebok 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Management Report – Financial Review

119

2014

/

03.2

/

adidas Group

/

2014 Annual Report

Group Business Performance

/

Statement of Financial Position and Statement of Cash Flows

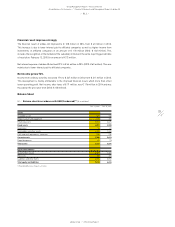

Total non-current liabilities increased 75% to € 2.422 billion at the end of December 2014 from

€ 1.386 billion in the prior year. Long-term borrowings increased to € 1.584 billion at the end of

December 2014 from € 653 million in the prior year. This development was primarily due to the

issuance of two Eurobonds with an overall volume of € 1 billion.

Shareholders’ equity increased 2% to € 5.624 billion at the end of December 2014 versus

€ 5.489 billion in 2013. The net income generated during the last twelve months, positive currency

translation effects of € 106 million as well as an increase in hedging reserves of € 210 million were

the main contributors to this development. This was partly offset by the dividend of € 314 million

paid to shareholders for the 2013 financial year as well as the repurchase of treasury shares in an

amount of € 300 million. The Group’s equity ratio at the end of December 2014 decreased to 45.3%

compared to 47.3% in the prior year.

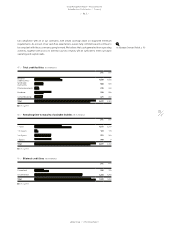

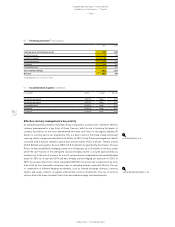

Operating working capital

Operating working capital increased 8% to € 2.821 billion at the end of December 2014 compared to

€ 2.618 billion in 2013. Operating working capital from continuing operations increased 12% (+13%

currency-neutral). This was mainly due to the increase in accounts receivable, reflecting the growth

of our business during the fourth quarter of 2014, as well as lower accounts payable at the end

of 2014. Average operating working capital as a percentage of sales from continuing operations

increased 1.0 percentage points to 22.4% (2013: 21.3%).

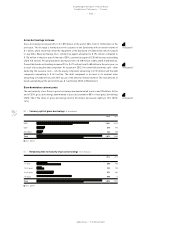

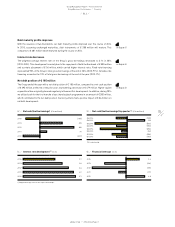

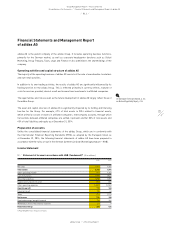

Investment analysis

Capital expenditure is defined as the total cash expenditure for the purchase of tangible and

intangible assets (excluding acquisitions). Group capital expenditure increased 16% to € 554 million

in 2014 (2013: € 479 million). Capital expenditure in property, plant and equipment amounted

to € 504 million and was thus above the prior year level of € 427 million. The Group invested

€ 50 million in intangible assets, representing a 4% decrease compared to the prior year (2013:

€ 52 million). Depreciation and amortisation excluding impairment losses/reversal of impairment

losses of tangible and intangible assets increased 10% to € 309 million in 2014 (2013: € 281 million).

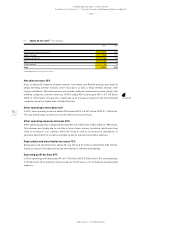

The majority of the Group’s capital expenditure was recorded in HQ/Consolidation, accounting for

58% (2013: 52%), and was mainly related to investments in the Group’s logistics infrastructure

and deployment of IT systems. The Retail segment accounted for 24% of the Group’s capital

expenditure (2013: 29%). Investments primarily related to the expansion of our store base for

the adidas and Reebok brands, particularly in emerging markets. Expenditure in the Wholesale

segment accounted for 13% of total capital expenditure (2013: 13%). Capital expenditure in Other

Businesses accounted for 5% of total expenditure (2013: 6%). From a regional perspective, capital

expenditure in North America accounted for 37% (2013: 16%) of the Group’s capital expenditure,

followed by Western Europe with 27% (2013: 41%), Greater China with 14% (2013: 13%), European

Emerging Markets with 7% (2013: 17%), Other Asian Markets with 7% (2013: 7%) and Latin

America with 7% (2013: 6%).

see Note 18, p. 213

see Diagram 39

see Note 26, p. 221

see Glossary, p. 258

see Diagram 40

see Diagram 41

see Diagram 42

see Diagram 43